Advertisement|Remove ads.

Tesla Stock Slips Premarket As Europe Turns To BYD And Stellantis’ Affordable EVs

- Europe’s auto market kept climbing in October, boosted by strong demand for electrified models.

- Automakers, including Renault, Volkswagen and BMW, posted gains while Tesla weakened.

- Dutch regulators challenged Tesla’s claim about a 2026 timeline for Full Self-Driving approval.

Tesla shares slipped 0.7% in premarket trading on Tuesday after fresh data showed the company losing more ground in Europe, where its October registrations tumbled while rivals BYD and Stellantis pulled ahead with the affordable electrified models that are drawing in cost-conscious buyers.

Europe’s Auto Market Extends Its Rebound

New-car sales across Europe increased for the fourth straight month in October, rising 4.9% from a year earlier to 1.09 million units. Spain and Germany recorded the strongest gains among major markets, while the UK and Italy were largely unchanged, Bloomberg reported.

Electrified models continued to lift demand, with plug-in hybrid registrations up 40% and fully electric cars increasing by almost a third.

Tesla Slumps As BYD Surges In October

Tesla’s performance stood out in the opposite direction. European registrations fell 48% in October, while BYD’s sales in the region more than tripled, outpacing Tesla for the month. Renault, the Volkswagen Group and BMW also posted gains.

The decline came after Tesla’s registrations in Sweden dropped 89% year-on-year to 133 vehicles. Sales were cut nearly in half in Norway and the Netherlands, and fell by about a third in Spain. France posted a modest 2.4% gain in October, though registrations there were still down roughly 30% for the first ten months of 2025.

Stellantis Gains Traction With Budget EVs

Stellantis, which has slowed some factory lines due to softer EV demand, has nevertheless seen increased interest in its more affordable electric offerings. The Citroen e-C3 is an example of a low-cost model appealing to buyers at a time when value is shaping much of Europe’s electrified-vehicle demand.

Regulators Push Back On Tesla’s FSD Messaging

Tesla recently faced regulatory friction in Europe. The Dutch authority RDW publicly refuted Tesla’s claim on X that it had “committed” to granting national approval for Full Self-Driving (Supervised) in February 2026. RDW said no such commitment had been made and urged Tesla fans to stop contacting the agency after the company encouraged supporters to thank RDW for the supposed approval timeline.

The regulator said the earliest possible decision could come after scheduled demonstrations in February 2026, but emphasized that approval is not guaranteed and depends on Tesla meeting Europe’s vehicle-safety requirements.

Chinese Automakers Increase Competitive Pressure

The surge in BYD’s European registrations is part of a broader expansion by Chinese EV makers, who are rolling out more plug-in and fully electric models across the region. Earlier this month, Tesla had been overtaken by several Chinese manufacturers, including BYD, Xpeng and Geely-owned Zeekr, in markets such as Denmark and Spain.

Global EV Race Intensifies

Separate Q3 data showed BYD retaining the top global share in battery-electric vehicles with 15.4%, delivering 582,522 BEVs in the quarter. Tesla ranked second with 13.4%, delivering 497,099 BEVs after a strong rebound tied in part to U.S. federal tax-credit deadlines.

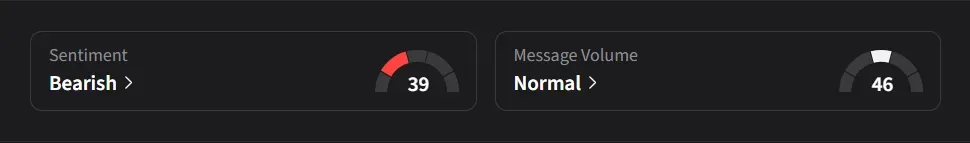

Stocktwits Mood For Tesla Stays Bearish

On Stocktwits, retail sentiment for Tesla was ‘bearish’ amid ‘normal’ message volume.

Tesla’s stock has risen 3% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)