Advertisement|Remove ads.

Tesla Supplier Arcadium Lithium Stock Jumps 30% Premarket On $6.7B Acquisition By Rio Tinto: Here’s How Retail Reacted

Mining major Rio Tinto (RIO) said on Wednesday it will acquire lithium producer and Tesla (TSLA) supplier Arcadium Lithium (ALTM) in an all-cash transaction for $5.85 per share, in what is reportedly considered as its biggest deal in 17 years.

Shares of Arcadium were trading nearly 31% higher in Wednesday’s pre-market session as of 7:45 a.m. ET.

The transaction, which values Arcadium’s diluted share capital at approximately $6.7 billion, represents a premium of 90% to its closing price of $3.08 per share on Oct. 04, 2024.

Rio Tinto CEO Jakob Stausholm said the acquisition is in line with the company’s long-term strategy. “This is a counter-cyclical expansion aligned with our disciplined capital allocation framework, increasing our exposure to a high-growth, attractive market at the right point in the cycle,” he said.

Rio Tinto expressed confidence it will maintain its strong balance sheet following the close of this transaction. The mining major expects Arcadium’s projected growth capital expenditure to represent approximately 5% of Rio Tinto’s group capital expenditure of up to $10 billion across 2025 and 2026.

The firm also expects over 10% compound annual growth rate in lithium demand expected through to 2040 leading to a supply deficit.

“With spot lithium prices down more than 80% versus peak prices, this counter-cyclical acquisition comes at a time with substantial long-term market and portfolio upside, underpinned by an appealing market structure and established jurisdictions,” Rio Tinto said in a statement.

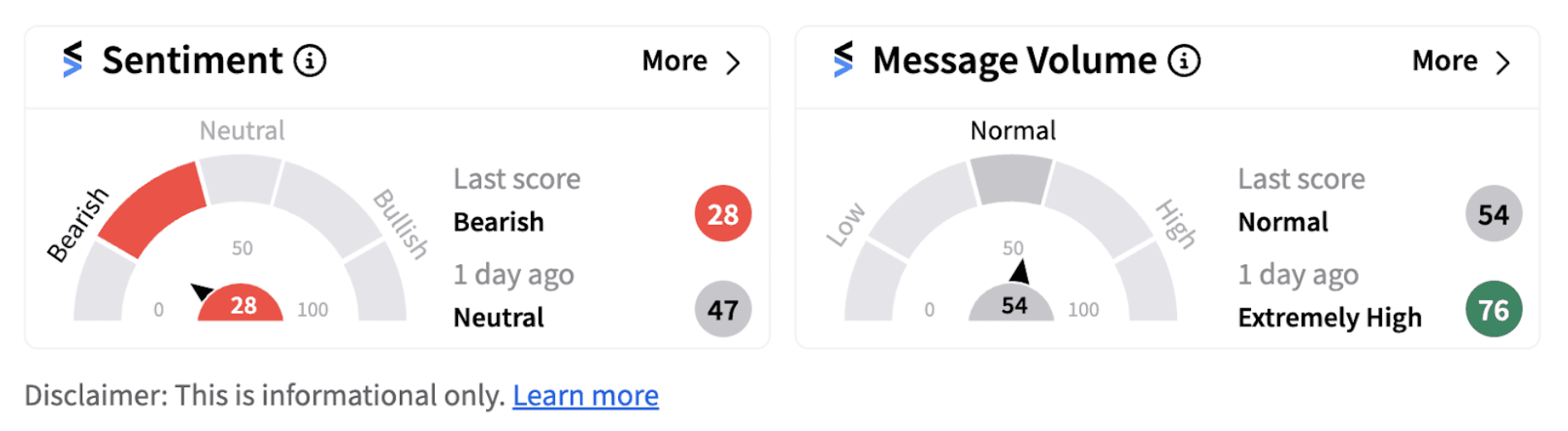

Stocktwits users who follow Rio Tinto are currently bearish on the stock.

At the same time, retail sentiment dipped into the ‘neutral’ territory from the ‘extremely bullish’ zone for Arcadium.

Before taking into account Wednesday’s pre-market movement, both Rio Tinto and Arcadium shares have recorded negative returns for the year so far. While NYSE-listed RIO shares are down over 10% on a year-to-date basis, Arcadium shares have lost over 37% during the period.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Wingstop_jpg_0737a8a046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239899916_jpg_cde8ab32f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_solaredge_technologies_resized_56b964ed87.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240244443_jpg_6b67e8f303.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)