Advertisement|Remove ads.

Texas Instruments Tumbles After-Hours As EPS Outlook Underwhelms: Analyst Spots ‘Stock Air Pocket’ Entry Opportunity

Texas Instruments, Inc. (TXN) shares took a tumble in Tuesday’s extended trading despite the maker of analog and embedded processing chips announcing a quarterly beat. Investors apparently did not take kindly to the fact that the midpoint of the third-quarter earnings guidance fell short of expectations.

TI stock was last seen trading down over 12% at $188.88 in overnight trading, but retail traders and a Wall Street firm stayed positive.

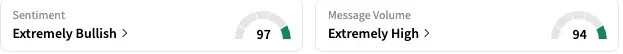

On Stocktwits, retail sentiment toward TI stock was ‘extremely bullish’ (97/100) by late Tuesday, improving from the ‘bullish’ mood seen a day ago. The 24-hour message change leading up to late Tuesday was a 2,454% increase.

TI reported earnings per share (EPS) of $1.41 and revenue of $4.45 billion for the second quarter of the fiscal year 2025, with both metrics increasing 16% year over year (YoY). On a quarter-over-quarter (QoQ) basis, the growth was 19.5% and 9%, respectively.

The Fiscal.ai-compiled consensus estimates were at $1.37 and $4.32 billion, respectively.

Analog revenue, accounting for 78% of the total, improved 18% YoY, while embedded processing revenue climbed a more modest 10%.

TI said a broad recovery in the industrial end market aided the sequential revenue growth.

CEO Haviv Ilan said, “Over the past 12 months, we invested $3.9 billion in R&D and SG&A, invested $4.9 billion in capital expenditures and returned $6.7 billion to owners.”

Looking ahead, the company guided third quarter EPS to be between $1.36 and $1.60 and revenue between $4.45 billion and $4.80 billion. At the midpoint, the guidance is at $1.48 and $4.63 billion, respectively.

The consensus estimates call for EPS of $1.51 and revenue of $4.59 billion, according to Stocktwits.

A bullish Stocktwits user said they will add Texas Instruments to their portfolio by Wednesday morning.

Another user expected ratings upgrades and price target hikes from research firms, noting that the company had beaten earnings expectations and revenue projections, and had raised its revenue guidance.

Commenting on the results, Baird analyst Tristan Gerra said, “We view stock air pocket as an entry point opportunity.” According to the analyst, the perceived tone change appeared to be driven by advanced purchases, which helped the second quarter, and the third quarter was returning to normal seasonality.

Gerra attributed the post-market weakness to investors' concerns about the change in the management tone on the call, combined with a sequentially flattish gross margin guidance. The stock gains over the recent months also introduced caution, he added.

“Net, in our view, Street expectations were for a linear reacceleration whereas the supply chain points to a continued ongoing cyclical recovery but without the continued benefit of advance purchases into 3Q,” the analyst said.

Baird raised its estimates for TI and reiterated an ‘Outperform’ rating. The firm also raised the price target for the stock to $220 from $175.

TI stock is up about 16.5% for the year-to-date period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)