Advertisement|Remove ads.

This Chipmaker Stock Tumbled Over 15% On Monday, Witnessed 8,400% Jump In Retail Chatter: Here’s What Happened

Chipmaker ON Semiconductor Corp. (ON) received a revised outlook from Susquehanna Financial Group on Tuesday following its second-quarter earnings, which the firm described as merely adequate.

The update included a downward adjustment in the company’s stock price target, reflecting tempered optimism for near-term performance. Susquehanna’s analyst Christopher Rolland reduced his 12-month price forecast for Onsemi to $65 from $75, as per TheFly. Despite the revision, he maintained a ‘Positive’ rating on the stock.

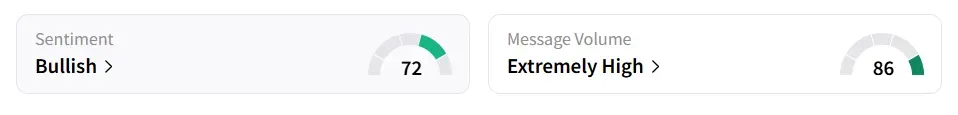

Onsemi stock inched 0.3% higher in Tuesday’s premarket. On Monday, the stock plunged 15.5%. However, on Stocktwits, retail sentiment toward the stock remained in ‘bullish’ territory with the message volume shifting to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock experienced an 8,400% explosion in user message count in 24 hours. Stocktwits users believe the shares were oversold.

Susquehanna cited that the recent quarterly performance benefited from unexpected inventory accumulation across distribution channels, which may have artificially supported the results and could potentially weaken future quarters.

The firm also highlighted that ON Semiconductor continues to reshape its production and product portfolio as it looks to 2026 for a more substantial recovery trajectory.

The company’s Q2 revenue declined 15.35% year-on-year (YoY) to $1.47 billion, but surpassed the analysts’ consensus estimate of $1.45 billion, as per Fiscal AI data.

Adjusted earnings per share (EPS) of $0.53 matched the consensus estimate. However, the company’s lower end of third-quarter (Q3) adjusted EPS guidance ($0.54 to $0.64) fell below the consensus estimate of $0.59.

ON stock has lost over 23% year-to-date and over 30% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_hut8_OG_jpg_66d77fe261.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_klarna_OG_jpg_830d4c6bf5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)