Advertisement|Remove ads.

Instil Bio Soars On Baird’s Price Target Boost: Retail Remains On Sidelines Amid Wild Surge

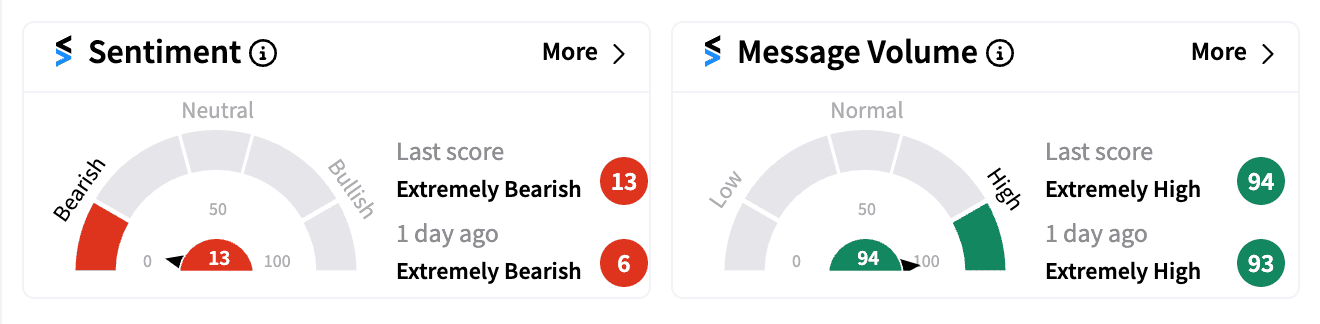

Shares of Instil Bio Inc. (TIL) skyrocketed over 60% on Friday, placing it among the top five gainers on U.S. stock exchanges and one of the top 20 trending tickers on Stocktwits, where message volume jumped 340%.

The surge came after Baird raised its price target on the stock to $180, implying a 146% upside, while maintaining an ‘Outperform’ rating.

Baird’s optimism is growing enthusiasm for Instil’s PD-L1xVEGF bispecific antibody, driven by positive data from peers like Akeso’s ivonescimab and Summit’s BNT327 in the same space.

Analysts noted recent results and data released ahead of the European Society for Medical Oncology (ESMO) meeting have increased faith in this drug class for treating cancers like triple-negative breast, RCC, and head and neck.

Baird expects continued momentum in this therapeutic area at ESMO, seeing further growth opportunities for Instil Bio. Despite the recent rally, the brokerage believes the stock remains undervalued, suggesting more room for gains.

Baird’s price target hike follows H.C. Wainwright’s upgrade a day earlier, when it raised its price target from $25 to $40 with a ‘Buy’ rating. Wainwright expressed increased confidence in Instil’s SYN-2510, highlighting its strong antitumor synergy compared to traditional VEGF blockers and PD-L1 antibodies.

Instil also announced a restructuring plan last week, including shutting down operations in Manchester, U.K., and laying off its remaining workforce there. The restructuring will cost up to $5.5 million, including $2.2 million in asset impairments and $2 million in severance.

Despite bullish analyst notes, retail investors remain wary. Sentiment on Stocktwits is ‘extremely bearish,’ with users questioning the sustainability of the stock’s rapid ascent.

“$TIL 13$ last week, now 77$,” noted one user.

Another warned, “$TIL from $9 to $70 in a few days!!! This is not going to go well next week.”

Adding to concerns, Instil’s fundamentals look shaky. The company reported zero revenue in the latest quarter, only $6.78 million in cash, and holds a $52.1 million mortgage construction loan on its Tarzana, California property, with an option to draw an additional $32.9 million.

Instil Bio has soared 624% in the last month, and retail investors are exercising caution for now.

Read next: MicroStrategy Stock Surges On $1B Bitcoin Buy Amid Crypto Dip: Retail Bulls Rejoice

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)