Advertisement|Remove ads.

Toast Stock’s Weekly Retail Buzz Soars On Raised 2025 View: Retail’s Extremely Bullish

Toast Inc. (TOST) stock registered a 200% jump in retail message volume over the past week after it raised its full-year earnings forecast.

The Boston-based firm forecasted 2025 adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) between $540 million and $560 million, compared with its earlier projection between $510 million and $530 million.

The company, which provides restaurants with an Android-based point of sale and management system, said last week its first-quarter revenue rose to $1.34 billion from $1.08 billion in the year-ago quarter.

Its annualized recurring run rate (ARR), a key financial metric Toast uses to measure the scale of its subscription and payment processing services, jumped 31% to $1.7 billion in the first quarter.

The company’s gross payment volume (GPV) rose 22% to $42.2 billion, and total locations increased 25% to about 140,000.

It reported a net income of $56 million for the quarter ended March 31, compared to a loss of $83 million in the year-ago quarter.

The company successfully onboarded Applebee’s and TopGolf to its payments platform this year.

Several brokerages have raised the stock’s price target following the earnings report. FinChat data shows the consensus price target is $42.44.

According to The Fly, Morgan Stanley analysts expect the company to drive steady share gains given its "market dominance," stemming from competitive differentiation and strong execution.

Keefe Bruyette analysts noted that Toast is proving resilient in the current macro environment, with consumer trends stable through early May.

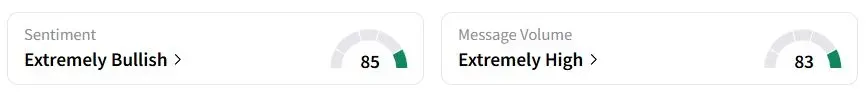

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (85/100) territory, while retail chatter was ‘extremely high.’

One user said the stock has “significant potential, especially considering it’s a recent IPO, which often allows for substantial price movements if it continues to gain momentum.”

Toast stock has gained 11.3% year to date.

Also See: CSX Stock In Focus After Signing Tentative Agreement With Union Representing 3,400 Workers

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)