Advertisement|Remove ads.

Toll Brothers Stock Drops After-Market On Q1 Earnings Miss: Retail Sentiment Sours

Shares of luxury home builder Toll Brothers Inc. (TOL) dropped nearly 6% in after-hours trading on Tuesday following fiscal first-quarter results that missed Wall Street expectations, dampening retail sentiment.

Toll Brothers reported Q1 earnings per share of $1.75, missing the $2.04 expected by Wall Street analysts. While its revenue stood at $1.86 billion, missing estimates of $1.91 billion, according to Stocktwits data.

Home sales were down 5% to $1.84 billion from the year-ago quarter, while delivered homes increased by 3%, the company said.

“While our net income and earnings per share came in below expectations, this was due primarily to impairments and a delay in the sale of a stabilized apartment property in one of our joint ventures. Our core homebuilding operations met expectations in the quarter,” said Douglas C. Yearley, Jr., chairman and CEO of Toll Brothers.

“Although demand has remained healthy in many of our markets and particularly at the higher end, affordability constraints and growing inventories in certain markets are pressuring sales – especially at the lower end.”

However, based on the gross margin embedded in its backlog and some early trends, it has reaffirmed all key homebuilding guidance for the full year 2025, including deliveries, average price, adjusted gross margin, SG&A margin and community count growth.

“We continue to expect another year of solid results," Yearley added.

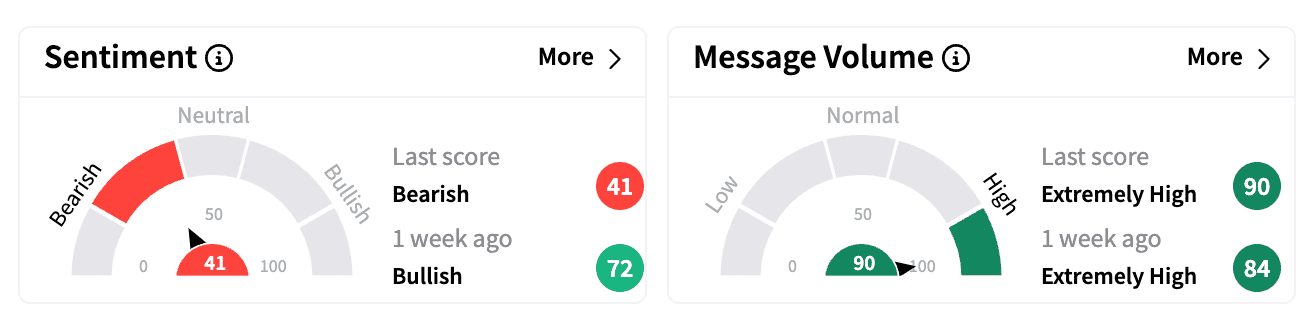

Sentiment on Stocktwits dipped to ‘bearish’ from ‘bullish’ a week ago. Message volume inched up in the ‘extremely high’ zone.

On Stocktwits, one bearish user speculated that the stock may drop further as pressures mount on the building materials sector.

In Q1, the company said it repurchased about 0.2 million shares at an average price of $127.02 per share for a total purchase price of $23.7 million, the company said.

Toll Brothers stock is down 3% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)