Advertisement|Remove ads.

These 3 Materials Stocks Led Retail Chatter Last Week

From policy-driven momentum to acquisition moves and funding announcements, these stocks became focal points for investors looking to capitalize on sector trends.

According to Stocktwits data, the following three materials stocks experienced the largest spikes in message volume in the week ending Feb. 7, 2025:

United States Steel Corporation (1,118% increase in chatter)

United States Steel (X) was at the center of retail chatter last week following speculation surrounding its pending acquisition by Japan’s Nippon Steel.

U.S. President Donald Trump claimed that Nippon Steel was reconsidering its $14.9 billion takeover of U.S. Steel in favor of an investment instead.

Trump stated that the Japanese steel giant would "explore an investment rather than a complete acquisition" and said he planned to meet with Nippon Steel’s CEO to discuss the matter.

Adding to the momentum, Trump proposed a 25% tariff on all steel and aluminum imports, fueling investor optimism about the stock’s prospects under a protectionist trade policy.

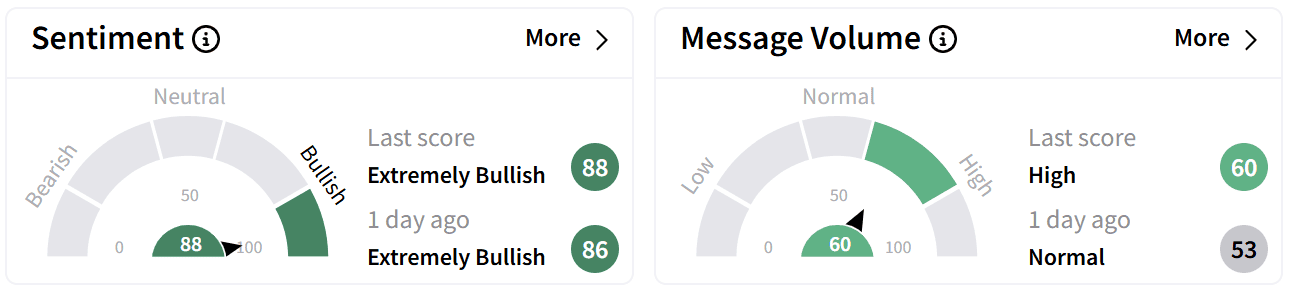

U.S. Steel shares gained over 4% in pre-market trading Monday following Trump’s comments. On Stocktwits, retail sentiment was ‘extremely bullish,’ accompanied by ‘high’ message volume.

Despite the surge in retaill chatter, the stock closed the week with a modest 0.6% gain.

Agnico Eagle Mines Limited (900% increase in chatter)

Gold miner Agnico Eagle Mines (AEM) saw heightened retail attention after completing its acquisition of O3 Mining, securing 95.6% of its outstanding common shares at $1.67 per share in cash.

The acquisition aligns with Agnico Eagle’s strategy of extending mine life at existing operations, testing near-mine exploration opportunities, and advancing key development projects.

Investors also anticipate the company’s fourth-quarter and full-year 2024 earnings release, scheduled for Thursday, Feb. 13.

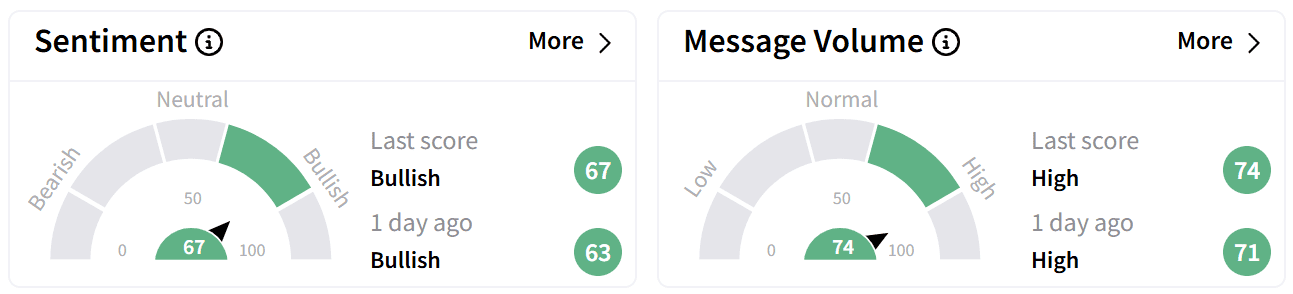

On Stocktwits, retail sentiment around Agnico Eagle was ‘bullish’ accompanied by ‘high’ levels of chatter in pre-market trade on Monday.

The stock has climbed over 5% over the last week and is up 2.5% in pre-market trade on Monday.

Critical Metals Corp. (800% increase in chatter)

Critical Metals (CRML) drew significant retail interest after securing $22.5 million in private placement financing through a PIPE (private investment in public equity) transaction.

As part of the deal, the company removed anti-dilution provisions from certain senior convertible notes and agreed to issue approximately 4.5 million ordinary shares at $5.00 per share.

Investors also received warrants to purchase an equal number of shares at $7.00, expiring in four years.

The financing is expected to support the development of the company's two key pre-production mining assets – the Tanbreez Rare Earths Project in Greenland and the Wolfsberg Lithium Project in Austria.

Critical Metals, which acquired a controlling stake in Tanbreez last summer, has also identified gallium, another high-value critical mineral, in recent drilling results.

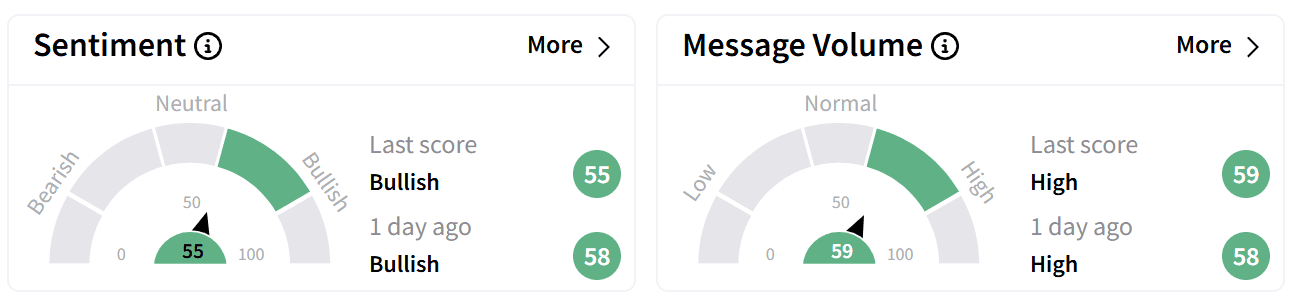

Despite the financing deal, the stock fell over 23% last week over concerns about dilution, but has rebounded 6% in pre-market trading Monday. On Stocktwits, retail sentiment remained ‘bullish’ accompanied ‘high’ levels of chatter.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: These 3 Semiconductor Stocks Drew The Most Retail Buzz Last Week

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)