Advertisement|Remove ads.

These 3 Semiconductor Stocks Drew The Most Retail Buzz Last Week

Semiconductor stocks remained a focal point for retail traders last week, with earnings reports and company-specific developments driving significant volatility.

According to Stocktwits data, the following three chip stocks experienced the largest spikes in message volume in the week ending Feb. 7, 2025:

Semtech Corporation (3200% increase in message volume)

Semtech (SMTC) shares fell 10% on Friday following the company’s disclosure that sales of its CopperEdge products, used in active copper cables, would come in lower than its prior "floor case" estimate of $50 million due to changes in server rack architecture.

The nose-dive was triggered by the announcement that sales of its CopperEdge products, used in active copper cables, would be lower than the company’s previously disclosed "floor case" estimate of $50 million due to rack architecture changes.

Piper Sandler slashed its price target from $75 to $55, maintaining an ‘Overweight’ rating. The firm cited Nvidia’s (NVDA) shift in rack architecture as a key driver of the lowered estimates for Semtech’s copper cable opportunity.

Meanwhile, Stifel cut its price target from $75 to $70 but retained a ‘Buy’ rating, reiterating that changes in customer feedback led to the reduced sales forecast.

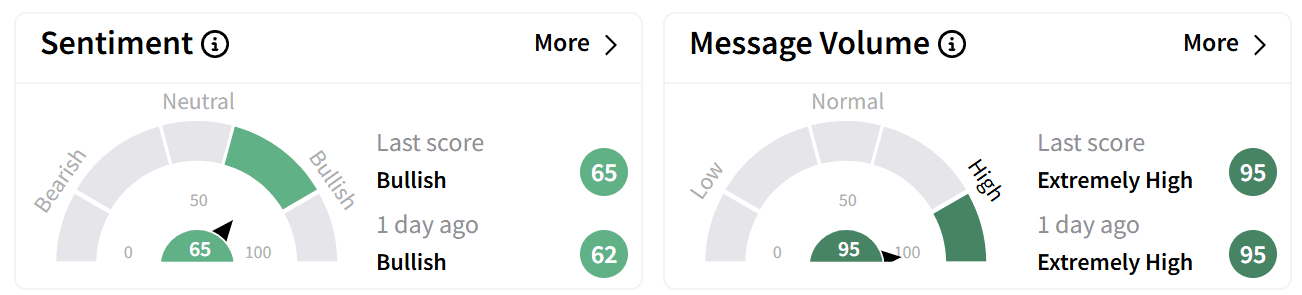

Despite the drop, retail sentiment on Stocktwits remains ‘bullish,’ with pre-market chatter at ‘extremely high’ levels on Monday.

Semtech’s stock declined 18% over the past week and is down over 29% in pre-market trade on Monday.

Monolithic Power Systems Inc. (1800% increase in message volume)

Monolithic Power Systems Inc. (MPWR) saw a spike in message volume after the company reported stronger-than-expected fourth-quarter earnings and issued an upbeat outlook for the first quarter of 2025 resulting in a string of price hikes by Wall Street.

Revenue for the quarter climbed 36.9% year-over-year (YoY) to $621.7 million, exceeding estimates of $608.07 million.

For the first quarter of 2025, the company expects revenue between $610 million and $630 million, well above the consensus forecast of $600 million on Koyfin.

For the full year 2024, Monolithic Power achieved record revenue of $2.2 billion, up 21.2% year-over-year—marking its 13th consecutive year of revenue growth.

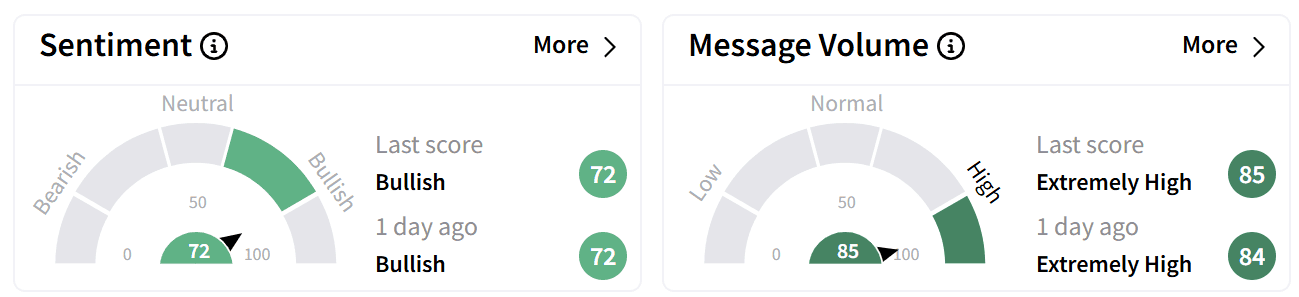

On Stocktwits, retail sentiment around Monolithic Power was ‘bullish’ accompanied by ‘extremely high’ chatter in pre-market trade on Monday.

The stock has climbed over 17% in the last week.

Skyworks Solutions Inc. (1500% increase in message volume)

Skyworks Solutions Inc. (SWKS) lost nearly a quarter of its market capitalization, with the shares falling to a five-year low on Wednesday despite beating first-quarter earnings expectations, after the company warned that increased competition for Apple Inc.’s (AAPL) semiconductor business would dent future sales by 20% to 25%.

Retail chatter has also been speculating who is most likely to benefit from Skyworks loss – Qualcomm (QCOM), Broadcom (AVGO), Apple Inc.’s (AAPL) own internal development or Qorvo (QRVO).

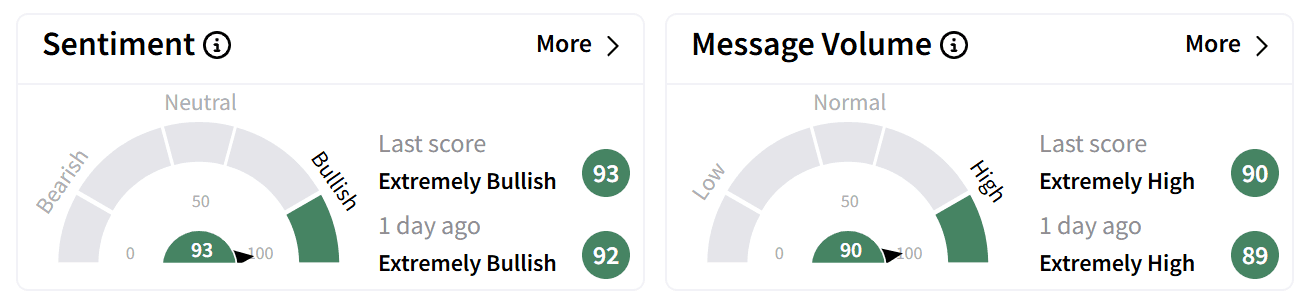

On Stocktwits, retail sentiment around Skyworks was ‘extremely bullish’ accompanied by ‘extremely high’ chatter in pre-market trade on Monday, despite last week’s setback.

The stock is down 24% over the last week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)