Advertisement|Remove ads.

Trident Shares: SEBI RA Jeet Bhayani Sees Accumulation Opportunity — Investors Should Watch ₹36 And ₹31 Levels

Trident shares cooled off on Thursday, slipping 2%, after a sharp 16% rally in the previous session.

SEBI-registered analyst Jeet Bhayani identifies Trident as a potential accumulation opportunity, citing notable improvements in the company’s fundamentals.

Bhayani points to a notable rebound in March-quarter earnings, with net profit more than doubling year-on-year to ₹133.4 crore, aided by a substantial reduction in finance costs.

This comes after a dip in third-quarter sales, suggesting a positive turnaround in performance.

The company’s operating profit margin (OPM) has remained steady, indicating ongoing challenges in expanding margins. However, the reduction in long-term and short-term borrowings reflects a strengthened balance sheet and a strategic focus on debt repayment.

He highlights that over the past decade, cash flow from financing activities suggests a consistent effort to reduce debt within a year.

From a technical perspective, Bhayani notes that Trident has staged a sharp 43% recovery after a substantial 67% decline from its peak, and has recently broken above the 200-day Exponential Moving Average on the daily chart — a bullish signal.

He suggests that buying opportunities may arise either above ₹36, given resistance at ₹35.5, or on a retracement to the ₹31–31.5 zone, with targets of ₹45 and ₹50, and a stop-loss at ₹28 in both scenarios.

Beyond the charts, Trident’s diversified business model remains a key strength.

He highlights that the company is the world’s largest wheat straw-based paper manufacturer and leads North India’s branded copier segment.

It is also a major player in terry towels and home textiles, with the paper segment boasting the highest operating margin among key listed peers in India.

Trident is the second-largest exporter of home textile products from India and a prominent manufacturer of industrial and battery-grade sulphuric acid in the northern region.

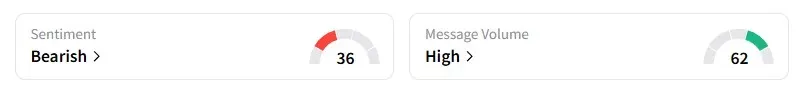

Retail sentiment, however, remained ‘bearish’ on this counter amid ‘high’ message volumes.

Trident shares are down 2% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)