Advertisement|Remove ads.

Trimble Stock Gains Pre-Market On Xona Satellite Deal, But Retail Sentiment Remains Bearish

Trimble Inc. (TRMB) rose as much as 1% in pre-market trading Tuesday after announcing a collaboration with Xona Space Systems to integrate its correction services with Xona’s Pulsar satellite system.

Correction services help improve the accuracy of global navigation satellite systems (GNSS) by reducing positioning errors caused by atmospheric interference, satellite orbit deviations, and clock drift.

Trimble’s technology refines raw satellite signals, providing precise location data crucial for industries such as agriculture, construction, and autonomous vehicles.

It will be integrated into Xona’s Pulsar network, designed to deliver high-precision, secure positioning for geospatial mapping, Internet of Things (IoT) applications, and other industries that rely on centimeter-level accuracy.

The company plans to launch its first satellites in late 2026, with the full network expected to go live in 2027.

As part of the collaboration, Trimble Ventures has made a strategic investment in Xona for an undisclosed amount.

Trimble also announced an integration of its fleet maintenance software with Daimler Truck North America, aiming to streamline commercial truck repairs and reduce downtime amid rising maintenance costs.

The new deals follow a 3.7% drop in Trimble’s stock on Monday, sending the shares to a four-month low of $65.88. The stock remains 14.5% below its 52-week high of $77.78, set on Jan. 24.

Trimble’s Vice President of Advanced Positioning, Olivier Casabianca, said combining the company’s correction services with Xona’s Pulsar network “has the potential to create a seamless, scalable solution that meets the evolving needs of industries reliant on precise satellite navigation.”

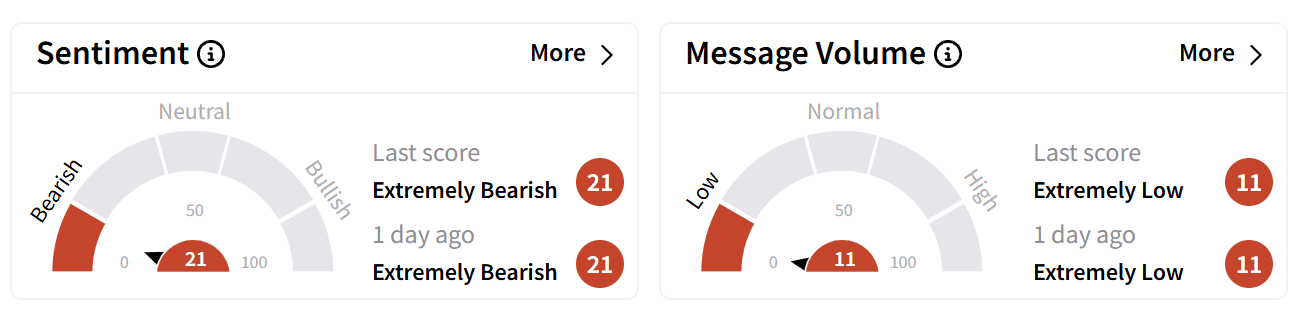

However, retail sentiment on Stocktwits around Trimble’s stock remained in the ‘extremely bearish’ zone.

Wall Street analysts, however, have taken a more optimistic view. Raymond James recently raised its price target on Trimble to $85 from $80, maintaining an ‘Outperform’ rating.

The brokerage cited strong fourth-quarter (Q4) results and 2025 guidance, highlighting a leaner cost structure and improved cross-selling opportunities.

Trimble posted Q4 earnings per share (EPS) of $0.89, slightly above analyst expectations of $0.88. Revenue rose 5% year-over-year to $983.4 million, surpassing estimates of $946.62 million.

For the first quarter (Q1) of 2025, the technology company expects EPS between $0.55 and $0.61 on revenue ranging from $794 million to $824 million. Its full-year guidance projects revenue between $3.37 billion and $3.47 billion, with adjusted EPS of $2.76 to $2.98.

Oppenheimer also lifted its price target to $90 from $88, citing continued momentum in annual recurring revenue growth.

Trimble’s stock remains down nearly 6% year-to-date and has lost 5.5% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: IBM’s Legal Momentum Continues With Supreme Court Victory Over BMC, But Retail Sentiment Is Cooling

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2258412162_jpg_8f6a6237d4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ocular_therapeutix_jpg_e5ff9ff87d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trip_Advisor_jpg_c5134f02d2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2147920616_jpg_ab875c9370.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cybercab_resized_jpg_1588e769f9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_zim_shipping_jpg_42b726c79d.webp)