Advertisement|Remove ads.

Trump Says Funds Left After $2,000 Tariff ‘Dividend’ Payments Will Be Used To ‘Substantially Pay Down National Debt’

- The president’s comments come a day after U.S. Treasury Secretary Scott Bessent stated that the $2,000 payment could be in the form of various deductions.

- This comes days after the hearing of the Trump administration’s tariff policy in the Supreme Court, drawing skepticism from judges on the legality of the levies.

- President Trump’s plans to pare the national debt come at a time when the federal tally has ballooned to over $38 trillion.

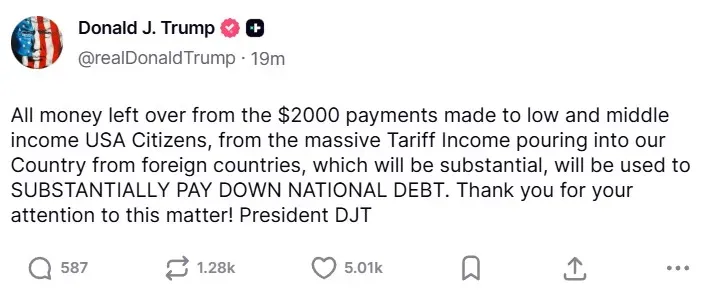

President Donald Trump on Monday stated in a post on Truth Social that funds left after making “tariff dividend” payments will be used to pare the national debt.

“All money left over from the $2000 payments made to low and middle income USA Citizens, from the massive Tariff Income pouring into our Country from foreign countries, which will be substantial, will be used to SUBSTANTIALLY PAY DOWN NATIONAL DEBT,” President Trump said in a post on Truth Social.

Tariffs Legality In Question

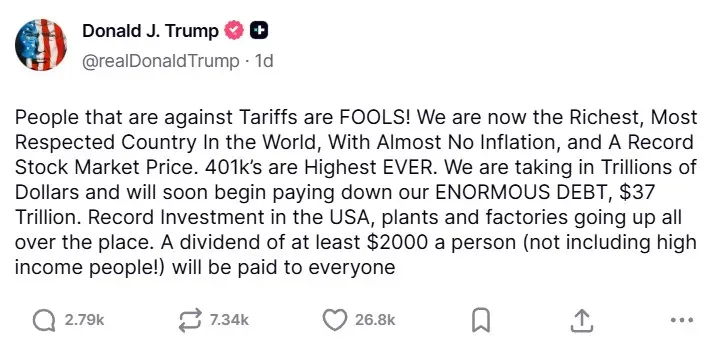

In a previous post on Sunday, President Trump called out those opposing his tariff policy, adding that there is “record” investment in the U.S. He also stated that everyone except high earners will receive a “dividend” of at least $2,000.

This comes days after the hearing of the Trump administration’s tariff policy in the Supreme Court. Chief Justice John Roberts and Justice Amy Coney Barrett pressed the Trump administration on a range of issues during the hearing last week. This included questioning whether the International Emergency Economic Powers Act (IEEPA) authorized President Donald Trump to impose emergency tariffs.

Tax Deductions

The president’s comments come a day after U.S. Treasury Secretary Scott Bessent stated in an interview with ABC News that the $2,000 payment could come in the form of various deductions being provided by the Trump administration, including no tax on tips, overtime, and social security.

“So, you know, those are substantial deductions that, you know, are being financed in the tax bill,” said Bessent.

Ballooning Debt

President Trump’s plans to use leftover tariff income to repay the national debt come at a time when the current outstanding tally has crossed the $38 trillion level, according to data from the U.S. Treasury.

Last week, World Economic Forum chief Borge Brende stated that governments have not been as indebted as they are now since 1945, at the end of the Second World War.

Meanwhile, U.S. equities gained in Monday morning’s trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.91%, the Invesco QQQ Trust ETF (QQQ) gained 1.49%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) rose 0.2%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘neutral’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down 0.14% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)