Advertisement|Remove ads.

Trump Berates Powell’s Leadership, Says Fed Chief Always ‘Too Late and Wrong’ On Rates

President Donald Trump renewed his criticism of Federal Reserve Chair Jerome Powell on Thursday, accusing him of delaying the much-needed interest rate cuts and calling for his termination.

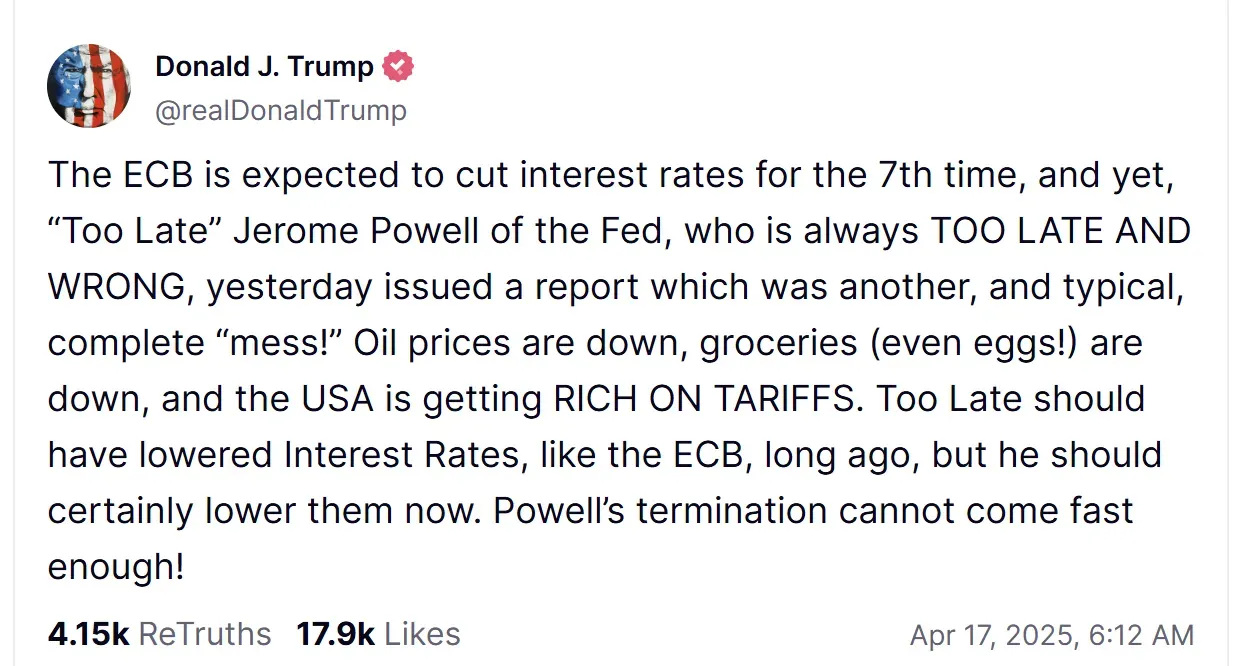

“Powell’s termination cannot come fast enough!” Trump wrote on Truth Social, following the Fed chief’s remarks that the central bank is waiting for more clarity before adjusting its policy stance.

Trump, who nominated Powell in 2017, has repeatedly argued that interest rates are too high and blamed the Fed Chair for what he views as policy mistakes.

It was unclear whether his comment referred to Powell’s scheduled departure in May 2026 or a desire to remove him earlier.

Powell’s current term as Fed chair runs through May 2026, and he retains a seat on the board of governors through 2028. The White House has not issued any official comment on the same.

In his Truth Social message, Trump criticized Powell’s handling of economic data, writing: “The [European Central Bank] ECB is expected to cut interest rates for the 7th time, and yet, ‘Too Late’ Jerome Powell of the Fed, who is always TOO LATE AND WRONG, yesterday issues a report which was another, and typical, complete ‘mess!’”

Trump also claimed that inflationary pressure was easing, saying oil and grocery prices are down and that the U.S. is “getting RICH” from tariffs.

On Wednesday, Powell told the Economic Club of Chicago that the Fed remains cautious about policy changes. “Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem,” he said.

The ECB followed through with its rate decision on Thursday, citing deteriorating growth conditions linked to global trade tensions, even as it acknowledged improved resilience within the eurozone economy.

U.S. equity markets showed a mild recovery as markets opened on Thursday. The Invesco QQQ Trust (QQQ), which tracks the Nasdaq 100, was up 0.2%, and the SPDR S&P 500 ETF Trust (SPY) edged 0.35% higher. Meanwhile, the SPDR Dow Jones Industrial Average ETF (DIA) remained in the red, down 1.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Trump Says ‘Big Progress’ Made In Japan Trade Talks – But No Deal Yet

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)