Advertisement|Remove ads.

Trump Calls Windmills, Solar ‘The Scam Of The Century’

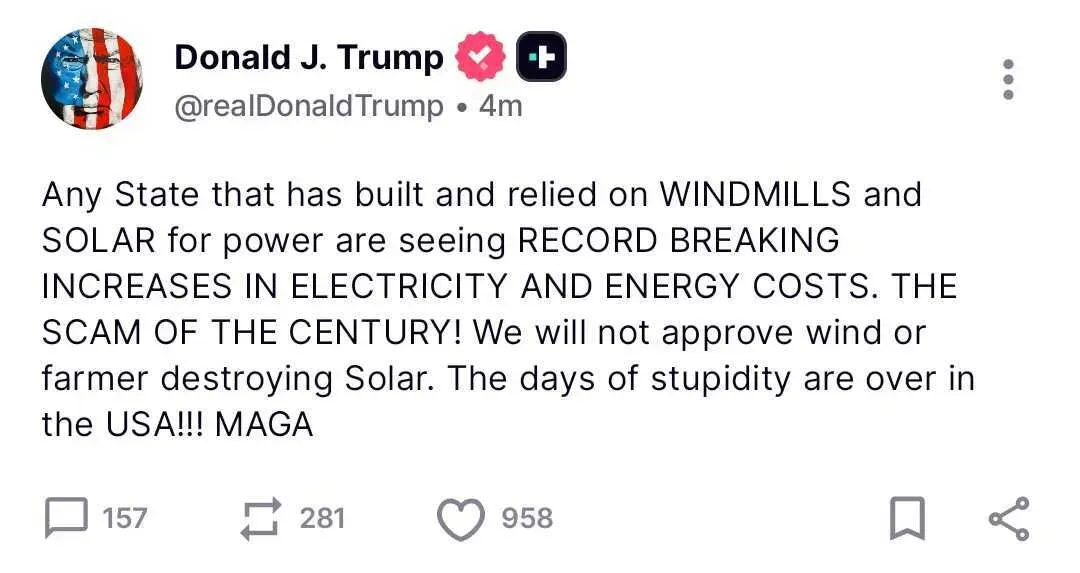

U.S. President Donald Trump on Wednesday renewed his attacks on renewable power over the weekend, posting that “windmills and solar” are driving “record breaking increases in electricity and energy costs.”

“THE SCAM OF THE CENTURY! We will not approve wind or farmer destroying Solar,” he wrote in a post on Truth Social.

The comments come after the U.S. Treasury Department and Internal Revenue Service issued new guidance on how clean energy developers can qualify for federal tax credits.

The guidance, released Friday, eliminated the long-standing “5% investment” safe harbor that had allowed solar and wind projects to qualify for incentives by paying at least 5% of costs upfront and showing work was ongoing. Under the new framework, companies must now meet a stricter “physical work” test to demonstrate construction has begun.

“This test focuses on the nature of the work performed, not the amount or the cost,” said the document. “Provided that physical work performed is of a significant nature, there is no fixed minimum amount of work or monetary or percentage threshold required to satisfy the Physical Work Test.” Small-scale solar facilities of 1.5 megawatts or less remain eligible under the 5% rule.

Stocks of solar companies increased losses in morning trade after Trump’s post. FRC Solar (FTCI) was the worst hit, down 248%, followed by Vivo Power (VVPR), which slipped 1.7%. SolarEdge Technologies (SEDG) and First Solar (FSLR) were each down nearly 1%. Enphase Energy (ENPH) edged 0.6% lower.

On Stocktwits, retail sentiment around First Solar’s stock, the biggest company by market cap of the set, moved lower within ‘extremely bullish’ territory over the past day. Retail sentiment around Enphase Energy’s stock remained in ‘bullish’ territory.

Read also: Bitcoin Selloff Drags Crypto Market Cap Below $4 Trillion – Cardano, XRP Hit Hardest

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)