Advertisement|Remove ads.

Trump's Former Economic Advisor Says He's Not A Big Fan Of Tariffs, But Adds Economy Doing 'Much, Much Better': Report

- Moore’s comments come days after the Bureau of Economic Analysis reported that the U.S. economy grew at an annualized rate of 4.3% in the third quarter, higher than the Dow Jones forecast of 3.2%.

- The economist highlighted President Trump’s claims of bringing trillions of dollars of capital into the U.S.

- He added that even if President Trump is off by 90%, that still means $1.8 trillion worth of capital flowing into the U.S.

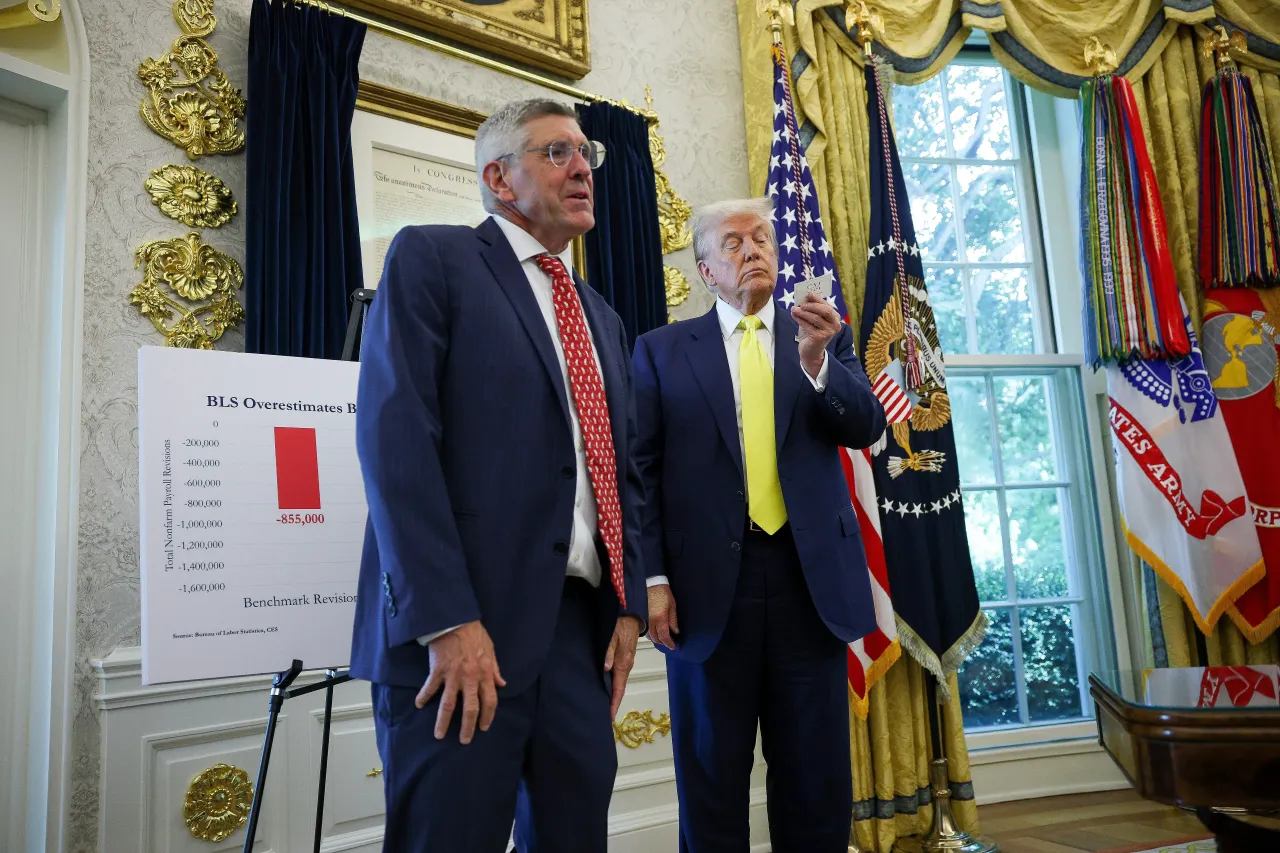

Stephen Moore, President Donald Trump’s former economic advisor, reportedly said on Monday that although he is not a big fan of Donald Trump’s tariffs, he appreciates some of the trade deals that the President has pulled off.

During an interview with CNBC, he highlighted the concessions made by South Korea, China, Japan, Canada, and the European Union in their trade deals with the Trump administration.

“We’ve got an economy that’s doing much, much better than the economists believed, and part of the reason the economists were so negative on the economy was exactly the point you just made, tariffs,” Moore told CNBC.

Moore’s comments come days after the Bureau of Economic Analysis reported that the U.S. economy grew at an annualized rate of 4.3% in the third quarter (Q3), higher than the Dow Jones forecast of 3.2%.

Looking Beyond Tariffs

Moore highlighted President Trump’s claims of bringing trillions of dollars of capital into the U.S.

“I’ve secured a record-breaking $18 trillion dollars of investment into the United States — which means jobs, wage increases, growth, factory openings, and far greater national security,” President Trump said in an address to the nation earlier this month.

The economist added that even if President Trump is off by 90%, that still means $1.8 trillion worth of capital flowing into the U.S. “That’s a huge amount of money being invested into the United States,” he said during the interview.

Not Everyone’s Onboard

Despite the Q3 GDP print blowing past Wall Street estimates, not everyone is as optimistic as Moore. Economist Justin Wolfers explained why headline economic growth hasn’t translated into how many Americans feel about the economy.

“Our individual economic realities are driven less by the national average and more by the policy choices—tariffs, taxes, and cuts—that decide who actually gets the gains from growth,” Wolfers said.

Economist Paul Krugman warned that while 2025 was a miserable year for small businesses, 2026 will be worse.

“The second Trump administration has been marked by increased government-imposed burdens on small business. High tariffs have been a body blow to the many small businesses that rely, one way or another, on imported goods,” he said. The economist added that small businesses will have to deal with spiking insurance costs, making it unaffordable for both their employees and, in many cases, themselves.

Meanwhile, U.S. equities declined in Monday morning’s trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down 0.47%, the Invesco QQQ Trust ETF (QQQ) declined 0.65%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) fell 0.53%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was up 0.07% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)