Advertisement|Remove ads.

Trump Media Files For ‘Truth Social Crypto Blue Chip ETF’ Hosting A Mix Of Digital Assets

Trump Media and Technology Group (DJT) on Tuesday sought approval for a new exchange-traded fund named the ‘Truth Social Crypto Blue Chip ETF’, which will directly hold a mix of digital assets, including Bitcoin (BTC), Ether (ETH), Solana (SOL), Cronos (CRO), and Ripple’s native token XRP (XRP).

Following the announcement, Trump Media and Technology stock traded 2% higher on Tuesday morning. The proposed fund will allocate 70% of its assets to Bitcoin, 15% to Ether, 8% to Solana, 5% to Cronos, and 2% to Ripple.

This represents Trump Media’s third attempt to register a cryptocurrency-focused ETF, following previous filings for a Bitcoin-only fund and a combined Bitcoin-Ether product.

If approved, these ETFs would enter an increasingly competitive market, where over 10 Bitcoin-focused funds and a range of other crypto-related investment vehicles are already available to U.S. investors. BlackRock’s iShares Bitcoin Trust ETF (IBIT) crossed 700,000 BTC in assets under management (AUM) on Monday, marking a new milestone for the fund.

According to the most recent data from CoinShares, Bitcoin exchange-traded funds currently manage $153 billion in assets. In comparison, Ethereum-based ETFs hold a combined $14.9 billion in assets under management.

Bitcoin’s price was trading at around $108,559 on Tuesday, having gained 0.2% in the last 24 hours. Meanwhile, Ethereum’s price had gained 1.1% in the last 24 hours to trade at around $2,574.

The ETF's debut is subject to SEC clearance of both the S‑1 registration statement and a Form 19b‑4 filing, which would permit its listing on NYSE Arca.

Trump Media must secure both approvals before offering ETF shares to investors.

The company, which is owned by President Donald Trump runs Truth Social, a social media network. In addition, Trump Media is preparing to debut Truth.Fi, a FinTech and financial services brand.

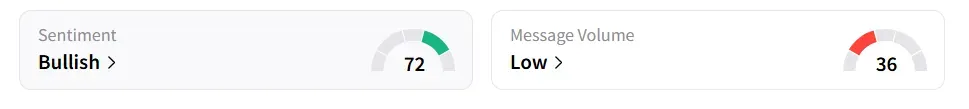

On Stocktwits, retail sentiment around Trump Media depreciated to ‘bullish’ from ‘extremely bullish’ territory the previous day, with ‘low’ levels of message volume.

Trump Media and Technology stock has lost 44% year-to-date and 37% in the last 12 months.

Also See: Chipmaker Sequans Secures $384M To Begin Bitcoin Treasury Strategy: Retail’s Jubilant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)