Advertisement|Remove ads.

Chipmaker Sequans Secures $384M To Begin Bitcoin Treasury Strategy: Retail’s Jubilant

Shares of French semiconductor company Sequans Communications S.A. (SQNS) announced on Tuesday the closure of a major private financing round totaling $384 million.

The company plans to use the funds to kickstart a Bitcoin (BTC)-focused treasury initiative, marking its formal entry into the digital asset space.

Following the news, Sequans Communications' stock surged over 27% in Tuesday’s pre-market. Meanwhile, Bitcoin gained 0.6% in the last 24 hours, trading at $108,946.70.

The funding round attracted over 40 institutional participants and included both debt and equity components.

The Offering involved the issuance of 139.4 million American Depositary Shares (ADSs), each representing 10 ordinary shares or equivalent pre-funded warrants, along with warrants to purchase an additional 20.9 million ADSs.

Each unit of an ADS and a warrant sold for $1.40, contributing $195 million to the raise.

Sequans also issued $189 million in secured convertible debentures maturing in July 2028, with an original issue discount of 4%. These are convertible into ordinary shares at a rate of $2.10 per ADS.

This portion of the Offering included warrants for another 20.2 million ADSs. If all warrants are exercised, the company could receive an additional $57.6 million, also earmarked for bitcoin acquisition.

“We believe Bitcoin’s unique properties will enhance our financial resilience and create long-term value for our shareholders,” said CEO Georges Karam. “Our intention is to continue acquiring Bitcoin in the future, using excess cash generated from our core business operations and additional proceeds.”

To manage the transition to digital assets, Sequans plans to collaborate with Swan Bitcoin, a financial services firm specializing in Bitcoin.

Sequans has joined a growing list of companies, such as Strategy (MSTR), and Marathon Digital Holdings (MARA), that are at the forefront of incorporating cryptocurrency into their financial planning.

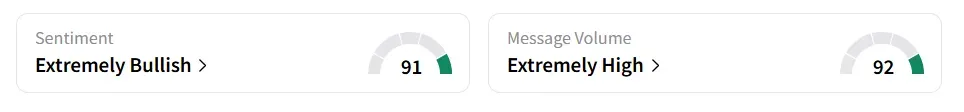

On Stocktwits, retail sentiment towards Sequans improved to ‘extremely bullish’ from ‘bearish’ territory the previous day. Message volume also jumped to ‘extremely high’ from ‘normal’ levels in 24 hours.

Sequans stock has shed 59% year-to-date and has added over 2% in the last 12 months.

Also See: IBM Targets AI-Driven Sectors With Launch of Power11 Servers

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)