Advertisement|Remove ads.

Trump Says China ‘Played It Wrong, They Panicked’ As Tariff War Fears Escalate

U.S. President Donald Trump lashed out at China on Friday after Beijing announced sweeping retaliatory tariffs on all U.S. imports, escalating global trade war concerns.

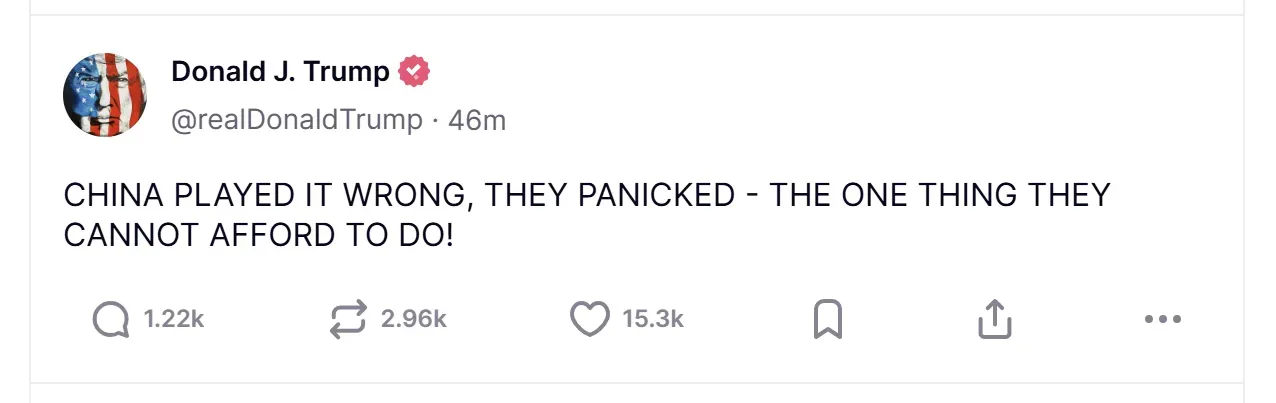

“China played it wrong, they panicked,” Trump said in a post on Truth Social, responding to the Chinese Finance Ministry’s decision to impose a 34% tariff starting April 10 – mirroring the rate Washington unveiled earlier this week.

The move marks an intensification of trade tensions between the world’s two largest economies.

China’s tariffs target a broad swath of U.S. goods and came alongside other punitive measures, including an expanded “unreliable entities list” and an antitrust investigation into the DuPont China Group, a subsidiary of the US company DuPont (DD).

DuPont’s stock was down more than 15% in morning trade on Friday.

Equity markets extended their slide on Friday as well. The Dow Jones Industrial Average (DJI) fell more than 1,000 points, or 2.5%, after shedding nearly 1,700 points on Thursday.

The S&P 500 (SPX) declined 2.8%, while the Nasdaq Composite dropped 2.9%, following a 6% loss the previous day.

Tech stocks continued to bear the brunt. Apple’s (AAPL) stock fell nearly 4% on Friday morning, capping a 10% weekly decline. Nvidia’s (NVDA) stock dropped over 7%, while Tesla’s (TSLA) shares were down almost 10%.

All three have deep exposure to China and are seen as especially vulnerable to retaliatory measures.

Financial stocks were also hit hard. Citigroup’s (CITI) shares slid 9%, JPMorgan (JPM) Chase stock fell 6.7%, and Goldman Sachs (GS) and Morgan Stanley (MS) shares lost over 8% each.

Trump attempted to reassure investors, saying the tariffs were designed to level the playing field and attract global investment. “It’s a great time to get rich,” he posted.

Investors found some support in a stronger-than-expected March jobs report, which showed the U.S. added 228,000 jobs. However, the unemployment rate ticked up to 4.2%, and recession fears remain elevated as the tariff fight deepens.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: US Stock Market On Track To Fall For Second Day In A Row — Here's Why

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298117_jpg_2f7ddb9196.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)