Advertisement|Remove ads.

Trump To Ban Institutional Buys Of Single-Family Homes In Affordability Housing Push

- Trump said he would discuss the topic as well as other housing and affordability proposals in a speech at the World Economic Forum in Davos later this month.

- He did not provide any further details on the same.

- Trump recently said that he would unveil housing reforms, the most aggressive ones in American history.

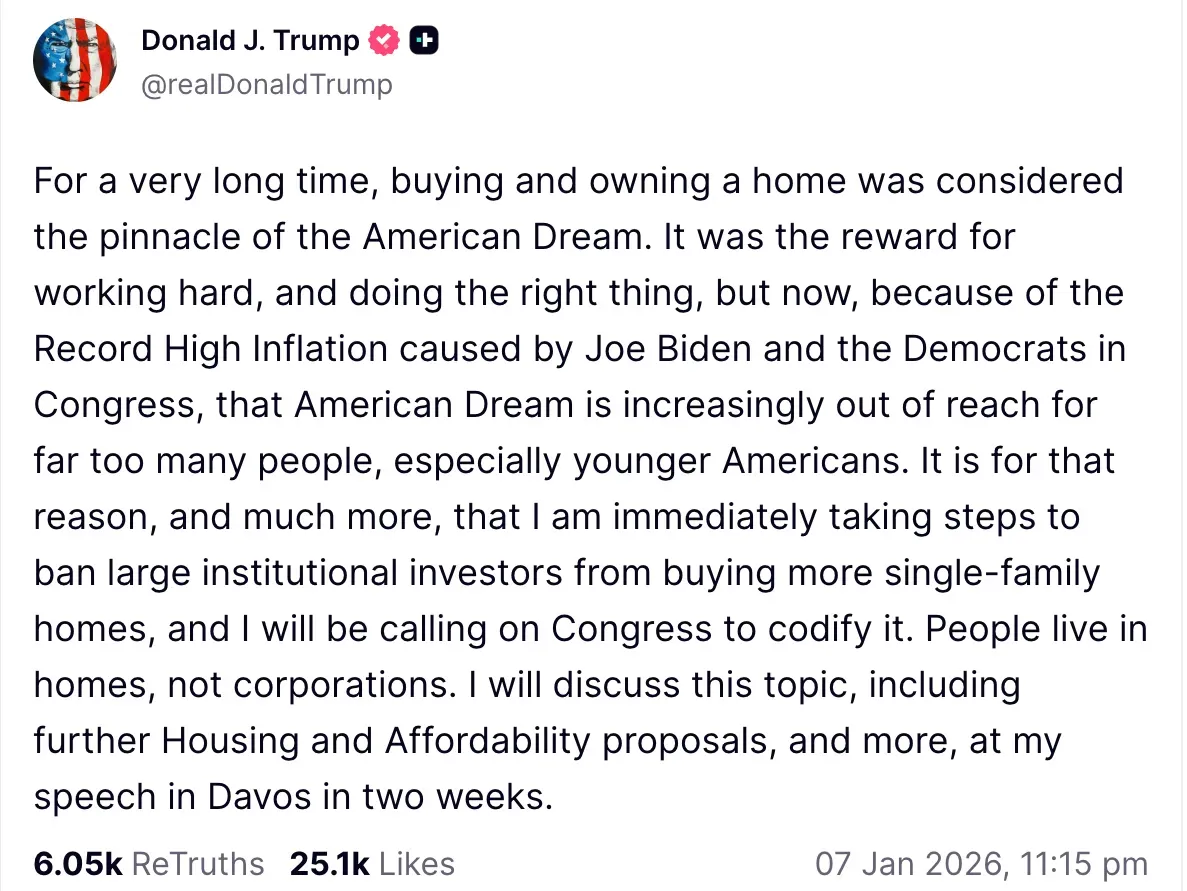

U.S. President Donald Trump said in a social media post on Wednesday that he will look to ban large institutional investors from buying single-family homes in an attempt to address housing affordability amid soaring home prices.

In a Truth Social post, Trump said that he would be calling on Congress to codify the move.

While the president did not provide any additional details, he added that he would discuss the topic as well as other housing and affordability proposals in a speech at the World Economic Forum in Davos later this month.

Soaring Prices

The U.S. housing market has been in a state of flux amid falling demand and increasing prices in recent years.

“For a very long time, buying and owning a home was considered the pinnacle of the American Dream,” Trump said, adding that increasing inflation has made it out of reach for many people, especially younger Americans.

“It is for that reason, and much more, that I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations,” he added.

Trump recently said that he would unveil housing reforms, the most aggressive ones in American history.

How Did Stocktwits Users React?

Shares of Blackstone Inc. (BX), which invests in single-family homes in America, declined nearly 5% at the time of writing. On Stocktwits, retail sentiment around BX stock jumped to ‘bullish’ from ‘bearish’ territory over a day amid ’high’ message volumes.

Shares of Invitation Homes Inc. (INVH), which provides single-family rental homes, declined over 9% at the time of writing while shares of American Homes 4 Rent (AMH) also fell over 6%.

Retail sentiment around INVH stock and AMH stock remained in the ‘bullish’ territory over a day amid ’high’ message volumes.

Meanwhile, the CCM Affordable Housing MBS ETF (OWNS), which tracks affordable housing, has gained over 4.5% in the past year. The SPDR S&P Homebuilders ETF (XHB), which provides exposure to American homebuilding and building products industries, is up 0.8% in the same time.

The iShares U.S. Home Construction ETF (ITB), that focuses on companies engaged in home construction, fell over 4.4% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)