Advertisement|Remove ads.

Tesla Analyst Sees Refreshed Model Y As 'Much-Needed' Growth Catalyst, But Retail Stays Bearish Amid Stock Slide

Tesla, Inc.'s stock closed over 2% lower on Monday, extending its losing streak to three days as investors weigh the impact of CEO Elon Musk's political entanglements and the company's ongoing sales challenges in key global markets.

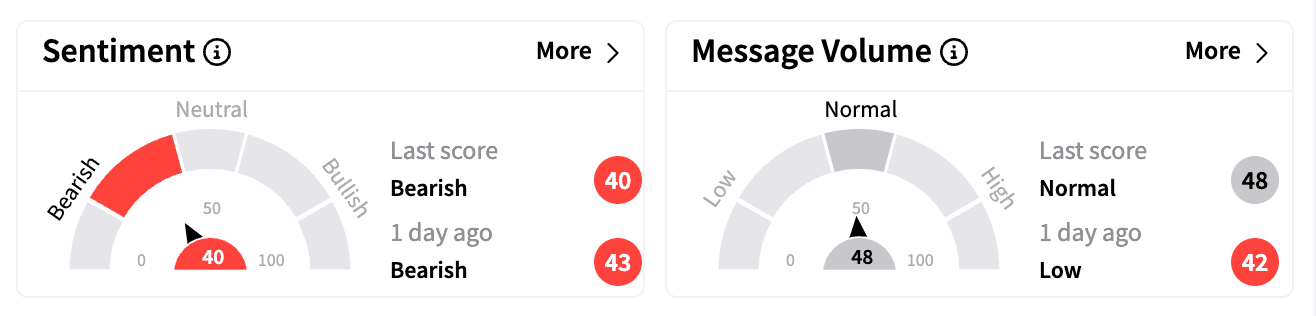

The stock, which has been steadily declining since mid-December, continued to slide in after-hours trading as retail sentiment remained overwhelmingly bearish.

Despite the recent weakness, Wedbush Securities, Tesla's most vocal bull on Wall Street, reaffirmed its confidence in its long-term prospects.

On Monday, analysts led by Dan Ives reiterated their 'Outperform' rating and $550 price target for Tesla, implying a more than 66% upside from current levels.

In a note to clients, Wedbush dismissed concerns about Musk's increasing involvement in President Donald Trump's administration, stating that while some investors see it as a distraction, it "does not change the future of Tesla."

The research firm pointed to the upcoming release of the refreshed Model Y, reportedly codenamed "Juniper," as a key catalyst that could help unlock demand in both the U.S. and China.

“This is the first of many launches ahead as we fully expect a lower cost vehicle from Tesla to hit the roads prior to July and could prove to be a much needed growth catalyst for global deliveries."

Wedbush also highlighted Tesla's advancements in autonomous driving and artificial intelligence-related (AI) developments, and the planned rollout of unsupervised full self-driving (FSD) in Austin by June.

Retail investors, however, remain unconvinced. Sentiment on Stocktwits turned increasingly bearish at Monday's close, with many traders expressing skepticism over Musk's priorities.

One user, referring to the latest controversy surrounding Musk and his Department of Government Efficiency (DOGE), posted a sarcastic message demanding that the Tesla CEO outline his recent contributions to shareholder value.

Another warned that many investors were setting themselves up for losses, arguing that fundamentals were deteriorating.

Tesla's recent struggles come amid a broader downturn in its core business metrics. The company reported its first-ever annual decline in deliveries in 2024, and some analysts have already flagged worsening sales trends in multiple key regions.

The refreshed Model Y is set to launch in China next month, although demand uncertainties persist in the face of intensifying competition.

And then, there are valuation concerns. Tesla has missed quarterly earnings and revenue estimates in three of the past four quarters. Yet the stock trades at elevated levels, with a trailing price-to-earnings ratio of 162x and a forward multiple of 116.4x, per Koyfin data.

Tesla shares have gained nearly 70% over the past year but have fallen more than 15% year-to-date. The recent slump reflects broader uncertainty over whether Musk's leadership — once seen as a key strength — has now become a liability.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)