Advertisement|Remove ads.

Tesla Bear Warns of ‘Disastrous’ Q1 Deliveries: Stock Heads For 5th Weekly Loss Amid Cautious Retail Mood

Tesla shares extended their decline in after-hours Thursday trading, putting the stock on track for its fifth consecutive weekly loss, its longest such losing streak since August last year.

According to The Fly, GLJ Research flagged worsening first-quarter delivery trends across multiple key markets, stating that Tesla's sales figures are shaping up to be "disastrous."

The research firm reported that deliveries in five major European countries were down 56% in the first 51 days of the quarter; China sales were down 7% from a year earlier in the first seven weeks, and Australia Model Y sales slumped 33% year-on-year (YoY) in January.

Based on these trends, GLJ estimates Q1 deliveries will come in around 360,000-370,000 units, significantly below Wall Street's current consensus of 426,977 units.

For comparison, Tesla delivered 386,810 vehicles in Q1 2024, which itself marked an 8.5% YoY decline.

GLJ maintains a 'Sell' rating on the stock.

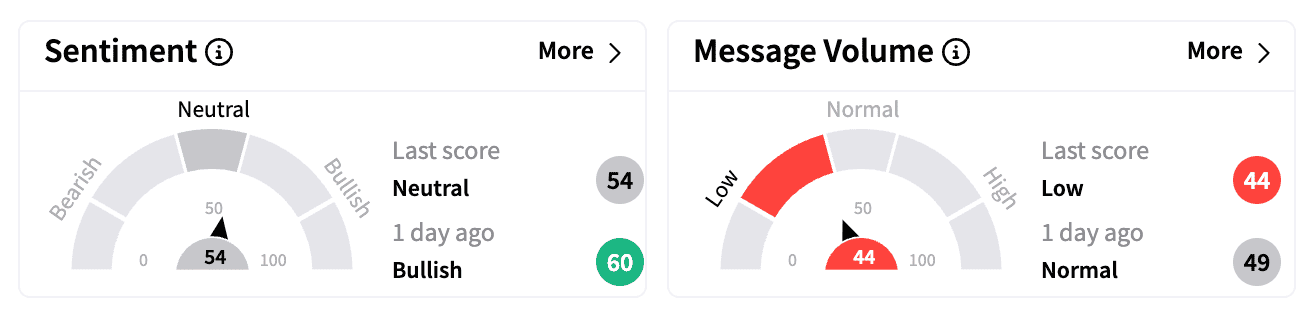

On Stocktwits, Tesla sentiment has recovered slightly from 'bearish' to 'neutral' over the past week but remains below 'bullish' levels seen a day ago.

Message volume has dropped by 46% over the last seven days, suggesting a minor decline in retail interest.

One skeptical trader noted Tesla's technical setup and warned that the stock could retest $240 without positive catalysts.

Another said they sold their long-term Tesla holdings, citing frustration over President Donald Trump's stance on Ukraine and urging European investors to sell U.S. stocks.

While some hedge funds have increased their Tesla positions, the stock's post-election rally following Trump's victory has stalled.

CEO Elon Musk's political entanglements are now drawing more scrutiny. He reportedly spends significant time in Trump's new Department of Government Efficiency (DOGE), focusing on federal budget cuts, and his endorsement of far-right parties has added to the controversy.

Tesla shares are currently trading just 3% above analysts' average price target of $342.58, but with a next-twelve-month price-to-earnings ratio of 124.7x — a steep premium.

The stock is down over 9% year-to-date but gained 83% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)