Advertisement|Remove ads.

Tesla Stock Ticks Up After Price-Target Hikes, But Retail Wary Of Key Resistance Level

Shares of Tesla, Inc. ($TSLA) rose about 1% on Monday following recent price-target hikes from two Wall Street analysts, although retail investors remained cautious about a looming technical resistance level.

Canaccord analyst George Gianarikas on Monday raised Tesla’s price target to $298 from $278, maintaining a ‘Buy’ rating, highlighting its growing profitability and potential to outpace its “Magnificent 7” peers starting in 2025.

He also pointed out that while Tesla has no major product launches in early 2025, it remains a medium-term growth story with favorable technicals.

Meanwhile, Daiwa raised its price target to $285 from $225, keeping a ‘Neutral’ rating.

The brokerage cited Tesla’s robust Q3 performance and future potential in Cybertruck, China energy storage, and the 4680 battery ramp as key drivers for margins and growth.

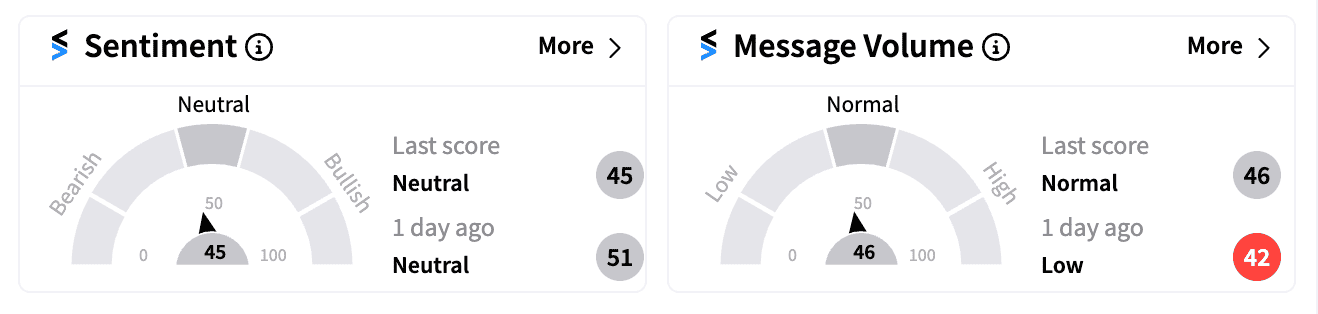

On Stocktwits, retail sentiment dipped slightly within the ‘neutral’ zone among Tesla’s 970,000 followers, as of 11:30 a.m. ET.

A user named “diamondoptionsinc” noted Tesla’s upcoming test of a $270 resistance level, which it has reportedly failed to close above since September 2023.

For Tesla to confirm a breakout, Canaccord suggests the stock should maintain a level above $262 for two consecutive weeks.

Some users remain hopeful Tesla will surpass the resistance level and target the $280 range soon.

Tesla has gained 8% year-to-date and is up about 26% since its recent Q3 earnings report, as of last close, although it still lags behind the broader S&P 500 and Nasdaq indices.

For updates and corrections, email newsroom@stocktwits.com

Read next: ON Semiconductor Stock Rises After Q3 Earnings: Retail Looks Past Disappointing Guidance

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)