Advertisement|Remove ads.

Big Hedge Funds Pile Into Tesla Stock, But Retail Stays Wary As 2025 Slump Continues

Tesla's stock was on a tear following Donald Trump's November presidential win, but that momentum has stalled into 2025. However, prominent hedge funds are betting big on the EV giant, while retail investors remain uncertain.

According to a 13-F filing last week, Bridgewater Associates, the hedge fund giant founded by Ray Dalio, added 153,589 shares of Tesla worth $62 million in the fourth quarter of 2024.

Interestingly, Bridgewater trimmed its exposure to other "Magnificent Seven" tech stocks.

Similarly, Daniel Loeb's Third Point increased its Tesla holdings by 100,000 shares, bringing its total to 500,000, while divesting from Apple.

These moves highlight a divergence between institutional investors and retail traders.

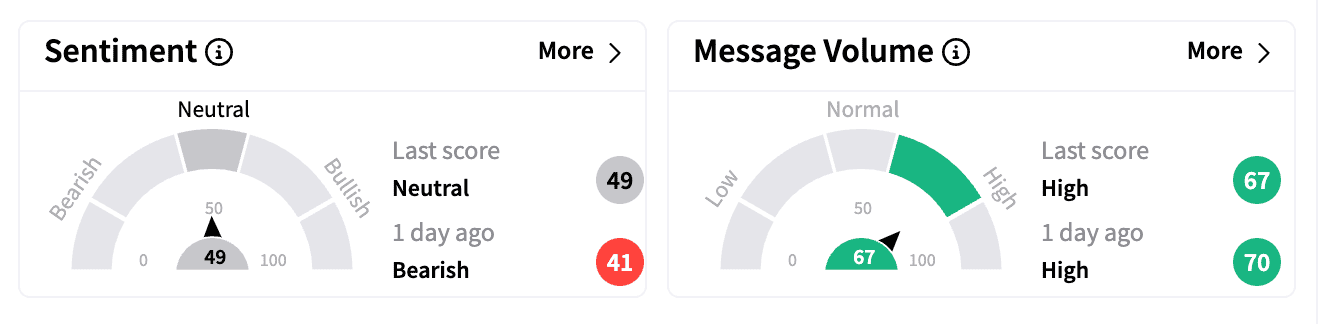

Tesla's sentiment on Stocktwits, where it has over a million followers, has recently remained tepid. The stock has now seen four consecutive weekly losing streaks. Ahead of Tuesday's opening, the sentiment reading was 'neutral.'

One user questioned the bull case for Tesla, dismissing price targets like $400 and $500 as unfounded, while another noted that Tesla could move higher if it breaks above $360.

However, a CNBC report noted that short interest for Tesla has climbed to 2.3%, and Wolfe Research considers the stock one of the best to short.

Tesla's current struggles are compounded by CEO Elon Musk's increased political focus, which many retail traders believe is hurting the company's prospects.

New reports also indicate that Tesla may face delays in obtaining Chinese regulatory approval for its full self-driving technology, potentially pushing back its plans for widespread deployment.

Tesla shares are down about 8% year-to-date and have fallen more than 26% from their all-time highs in December.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)