Advertisement|Remove ads.

Boeing Falls 3% Pre-Market After Union Rejects Deal While Satellite Disaster Adds Pressure: Retail Bearish

Boeing Co. ($BA) shares fell nearly 3% premarket Thursday after its workers rejected a proposed deal to end their ongoing strike, and the company faced another setback with the explosion of its satellite in space.

Boeing workers rejected the company’s latest offer to hike wages by 35% over the next four years, reinstate incentive bonuses, and a $7,000 ratification bonus.

“After 10 years of sacrifice, we still have ground to make up. We hope to resume negotiations promptly,” the machinists’ Union said in a statement after 64% of the 33,000 members of the International Association of Machinists and Aerospace Workers (IAM) voted against the new terms.

The Anderson Economic Group's (AEG) latest analysis estimates that the strike has led to $7.6 billion in direct economic losses so far. Of this amount, Boeing has absorbed $4.35 billion, while its suppliers have faced nearly $2 billion in losses.

In addition to the 6-week strike, a satellite explosion has added to the company’s woes. The explosion of the Boeing-made Intelsat 33E satellite has resulted in “total loss” of the device.

Intelsat and Boeing are currently working to determine the cause of the explosion.

The resulting debris could potentially be a threat to other satellites in orbit at some point. The U.S. Space Force says it is tracking 20 pieces of debris from the destroyed satellite and there was no immediate threat to other orbiting space equipment.

This isn’t the first Boeing satellite that has been declared a total loss at Intelsat. In 2019, the company lost a unit after three years due to what was either a meteoroid or a wiring flaw.

These developments come just a day after the aerospace giant reported a $6 billion loss in its third-quarter earnings.

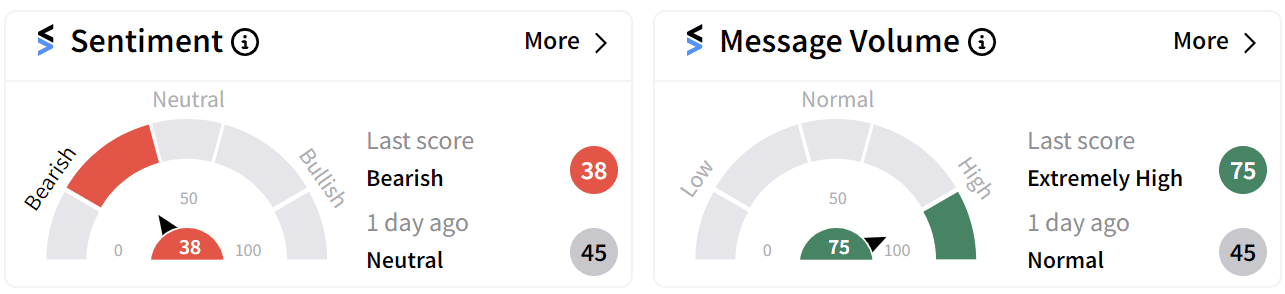

Retail sentiment on Stocktwits has slipped into the ‘bearish’ (38/100) territory from ‘neutral’ just a day.

Boeing’s stock has lost 39% of its value so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

Read more: Boeing Shares Slip After Q3 Losses As CEO Targets Recovery: Retail Sentiment Unfazed

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)