Advertisement|Remove ads.

Tesla Stock Rockets To Best Day In 12 Years As Trump Cools Tariff Heat: Retail Gets Charged Up

Shares of Tesla, Inc. soared more than 22% on Wednesday, marking their best single-day performance since May 2013, as retail sentiment turned sharply bullish following President Donald Trump's partial reversal on global tariffs.

The stock closed at its highest level in over a week after Trump announced a 90-day pause and reduced tariff rates for countries currently negotiating with the U.S. However, he simultaneously raised tariffs on Chinese imports to 125%.

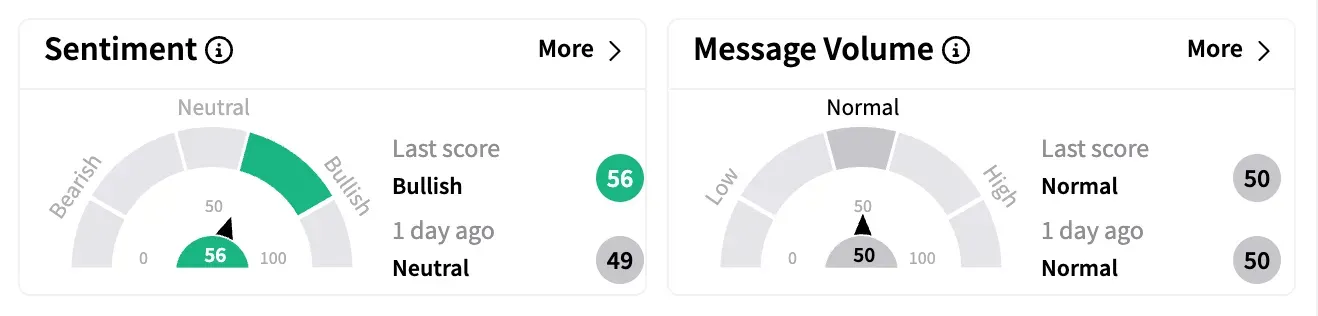

On Stocktwits, sentiment for Tesla jumped into 'bullish' levels from 'neutral' a day ago amid a 23% rise in message volume, indicating a rebound in retail investor interest following the recent stock slump.

"Can we have a moment of silence for all the short sellers getting cooked today?" said one user.

Another said the stock was "back above the all-important 20 ema [exponential moving average] on the monthly today, closing at 272."

In an interview with Barron's, ARK Investment Management CEO Cathie Wood — one of Tesla's most vocal backers — helped add to Wednesday's optimism, stating that the company is poised to "help bring affordability back into auto buying" with a $30,000 model.

She also highlighted the anticipated launch of Tesla's Robotaxi service in June as a key growth catalyst.

Wood argued that Tesla would fare better than other U.S. automakers on the tariff front due to its heavier reliance on North American parts.

Addressing concerns arising from CEO Elon Musk and his close ties to Trump — which have stirred a branding crisis — Wood remained unfazed, saying that news cycles move quickly and that ultimately, "the best cars are going to win."

According to The Fly, Benchmark lowered its price target on Tesla to $350 from $475 but kept a 'Buy' rating and retained the stock on its "Best Ideas" list.

The research firm admitted that Tesla's recent stock pullback and sales declines were concerning but pointed to the impending release of a new model in the second quarter and the Robotaxi launch in Texas as positive triggers.

Tesla's stock has lost more than 30% this year. The stock was down over 1% in Wednesday's after-hours trading.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)