Advertisement|Remove ads.

TSM Second Quarter Earnings Beat Analyst Estimates: Here’s How Retail Reacted

Taiwan Semiconductor Manufacturing Company (TSM) on Thursday announced an upbeat set of second quarter earnings that topped analyst estimates led by an increasing demand for chips used in artificial intelligence (AI) applications. TSM reported a 40.10% jump in net sales at New Taiwan Dollar (NT) 673.51 billion as compared to a Street estimate of NT657.58. Net income came in at NT247.85 billion as compared to an estimate of NT238.80 billion.

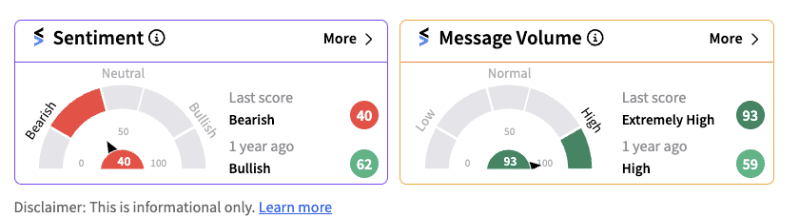

Despite the better-than-expected earnings, retail sentiment remained in bearish territory (40/100) on Stocktwits supported by extremely high message volumes (93/100) that hit a one-year high. Some users are concerned the positive earnings report may not be enough for the stock to hold on to the significant gains it is sitting on.

Moreover, a report that indicated the US may be considering tough trade restrictions on semiconductor companies had led to a sell-off in chip stocks on Wednesday – something that could be preventing retail from being overly bullish on the sector.

TSM said in dollar terms, second quarter revenue stood at $20.82 billion, up 32.80% year-over-year.

Wendell Huang, Senior VP and Chief Financial Officer at TSMC said that the second quarter was supported by strong demand for its 3 nanometer and 5 nanometer technologies, partially offset by continued smartphone seasonality.

During the second quarter, shipments of 3-nanometer accounted for 15% of total wafer revenue. Meanwhile, 5-nanometer accounted for 35% of the revenue and 7-nanometer accounted for 17%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 67% of total wafer revenue.

“Moving into third quarter 2024, we expect our business to be supported by strong smartphone and AI-related demand for our leading-edge process technologies,” Huang said.

For the third quarter, the company expects its revenue to come in between $22.40 billion and $23.20 billion. This tops an earlier Street estimate of $22.60 billion.

Based on the exchange rate assumption of one dollar to 32.50 NT dollars, it expects a gross profit margin between 53.50% and 55.50% and an operating profit margin between 42.50% and 44.50%.

Shares of the firm have risen over 68% since the beginning of the year to $171.20. Recently, Needham reportedly raised its price target on the stock to $210 from the earlier target of $168 and maintained a ‘Buy’ rating on the stock.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)