Advertisement|Remove ads.

Sarepta Therapeutics Stock Crashes After-Hours On DMD Trial Failure, Q3 Print — Retail Still Sees Long-Term Comeback

- The Phase 3 ESSENCE study for Amondys 45 and Vyondys 53 failed to meet its primary endpoint, showing only modest numerical differences compared with placebo.

- Third-quarter revenue declined to $399.4 million as Elevidys sales fell following the suspension of shipments to non-ambulatory patients.

- Stocktwits traders remained upbeat, pointing to long-term potential from label expansion, European growth, and possible M&A opportunities.

Sarepta Therapeutics shares tumbled 38% in after-hours trading on Monday after the company’s latest trial for two Duchenne muscular dystrophy drugs failed to meet its main goal.

The Phase 3 ESSENCE study, which tested Amondys 45 and Vyondys 53, showed only numerical improvements compared with a placebo and did not reach “statistical significance” on the key measure of stair-climbing speed after 96 weeks. The difference between the two groups was just 0.05 steps per second.

Sarepta said the Covid-19 pandemic disrupted the nine-year study and that when pandemic-affected data was excluded, the results looked more favorable.

Disappointing Q3 Print

The company’s third-quarter revenue fell to $399.4 million from $467.2 million a year earlier, driven mainly by a $49.5 million dent in Elevidys net product revenue following Sarepta’s June suspension of shipments to patients who cannot walk in the U.S. “Other revenues” decreased $8.1 million, primarily reflecting $9.2 million lower contract manufacturing revenue tied to fewer Elevidys shipments to Roche.

The company had a net loss of $179.9 million, reversing a profit of $33.6 million a year earlier. Cash reserves also dwindled to $865 million from $1.5 billion at the end of 2024.

While Sarepta said it has refinanced debt and cut costs, investors were more focused on widening losses, higher production costs, and write-offs tied to manufacturing issues and debt adjustments.

Regulatory Setbacks Add Pressure

Sarepta said it is in talks with the U.S. Food and Drug Administration over the Elevidys label, which is expected to include a boxed warning and the removal of the non-ambulatory patient indication, signaling a move that could limit the drug’s commercial reach. The company said it plans to meet with regulators to discuss a path to traditional approval for Amondys 45 and Vyondys 53, noting their strong safety records and real-world data showing potential long-term benefits.

Stocktwits Traders See Long-Term Upside

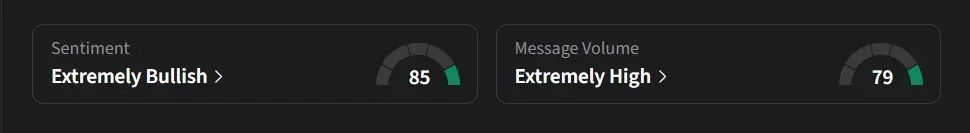

On Stocktwits, retail sentiment for Sarepta was ‘extremely bullish’ amid a 1,988% surge in 24-hour message volume, placing it among the most trending equities on the platform.

One user said the company’s core products, which have generated more than 80% of revenue for years, “showed no real clinical benefit,” calling a massive sell-off “inevitable.” The user added that while a short-term rebound looked unlikely, longer-term optimism could come from potential label expansion for Elevidys, European approvals, or even a merger or acquisition.

Another user said they bought Sarepta shares around $18, averaged down to $14, and sold parts below $10 at a loss before the stock later rebounded to $23. They said they now plan to hold all remaining shares, calling the company a strong long-term bet and adding they would buy more if it dips again.

Sarepta’s stock has declined 80% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)