Advertisement|Remove ads.

TSM Stock Gets A Price Target Boost As AI Demand Strengthens: Retail Calls It ‘Backbone Of AI Chips Right Now’

Taiwan Semiconductor Manufacturing Co. (TSM) received a vote of confidence from Needham, which lifted its price target to $360 from its prior estimate of $270.

The update follows a strong third-quarter (Q3) performance from the chipmaker. TSMC’s Q3 revenue of NT$989.92 billion ($33.10 billion) and earnings per ADR (EPS) of NT$17.44 ($2.92) both exceed the analysts’ consensus estimate of NT$960.41 and NT$15.45, respectively.

Needham said TSMC's Q3 revenue not only surpassed the top end of its guidance range but also held firm on margins, despite concerns about currency-related impacts. The company delivered a gross margin of 59.5%, calming fears of a potential decline due to foreign exchange volatility.

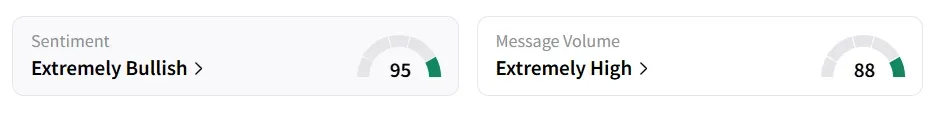

TSMC stock traded over 1% lower on Thursday afternoon and was among the top trending equity tickers on Stocktwits. Retail sentiment around the stock remained in ‘extremely bullish’ territory while message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock experienced a 325% increase in user messages over 24 hours, as of Thursday morning. A Stocktwits user called the company the “backbone of AI chips right now”.

Needham highlighted that demand for AI-related chips is strengthening, adding momentum to TSMC’s already robust outlook. While access to the Chinese AI market remains limited, the firm noted that growth prospects elsewhere are more than making up for it. The company’s capacity build-out in Arizona is also gaining speed, it added.

TSMC stock has gained over 51% year-to-date and over 59% in the last 12 months.

Also See: ASTS Stock Marches Past $100 Mark For First Time: Retail Says It’s A ‘Dream Come True’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)