Advertisement|Remove ads.

Twilio Edges Higher Ahead Of Q4 Results As Retail Anticipates Earnings Beat

Twilio Inc. (TWLO) edged higher on Thursday afternoon ahead of its fourth quarter (Q4) earnings results, scheduled for after market close.

The communications services company is expected to report earnings of $1.03 per share on revenue of $1.18 billion, according to Stocktwits data.

It already released its preliminary results for the quarter in January and a multi-year outlook during its Investor Day.

Twilio’s preliminary results indicate 11% revenue growth, with adjusted operating income exceeding the top end of its October forecast of $185 million to $195 million.

Looking further ahead, the company projects adjusted operating margins to expand to between 21% and 22% by 2027, up from 16.1% in the most recent quarter.

Twilio also aims to generate $3 billion in free cash flow over the next three years, significantly outpacing the $692 million in free cash flow reported across 2022, 2023, and 2024.

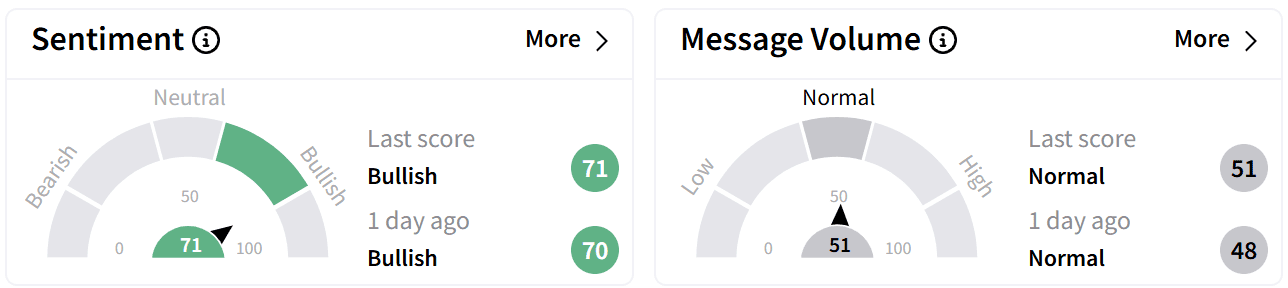

On Stocktwits, retail sentiment around Twilio’s stock remained in the ‘bullish’ zone accompanied by ‘normal’ levels of chatter.

Some users reported being nervous going into the earnings.

Others anticipate the stock to rally to at least $180 after the announcement.

Twilio has already surpassed the average analyst price target of $130, according to Koyfin data. The stock’s highest Wall Street target is $185, implying a 28% upside from current levels.

At the time of writing, Twilio’s stock was trading just 4% below its 52-week high of $151.95. The stock has more than doubled in 2024, gaining 32% year-to-date, outpacing the broader market.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Toshi Tops Meme Coin Chatter As Token Hits New Weekly High, Bitcoin Stalls

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)