Advertisement|Remove ads.

Uber Technologies Terminates Agreement To Acquire Delivery Hero’s Foodpanda Business In Taiwan: Retail Stays Bearish

Uber Technologies Inc (UBER) shares traded nearly 1% higher in Wednesday’s pre-market session despite the company deciding to terminate the agreement to acquire Delivery Hero’s Foodpanda business in Taiwan.

Delivery Hero said the development comes after local regulatory authorities, including the Taiwan Fair Trade Commission (TFTC), did not approve the deal, while the relevant appeal period expired.

The company also stated that Uber is required to pay a termination fee estimated to be about $250 million, per the agreement signed on May 14, 2024.

In December 2024, Taiwan’s anti-trust regulator rejected Uber’s $950 million bid to acquire Foodpanda, raising concerns it might be anti-competitive.

Fair Trade Commission Vice Chairman Chen Chih-min reportedly said at a briefing in Taipei that Uber Eats' main competition comes from Foodpanda, highlighting that their combined market share would be over 90%.

“The merger would lead to far greater disadvantages from competitive restraints compared to the overall economic benefits,” Chen said.

If the deal had gone through, it would have been one of Taiwan's largest-ever international acquisitions outside of the semiconductor industry.

Uber had earlier targeted closing the acquisition by the first half of 2025. The firm argued that consumers would benefit from adding Uber’s wider selection across northern Taiwan and major urban centers to Foodpanda’s comparative strength in southern Taiwan and smaller cities.

"Better service for consumers helps drive more orders from merchants, and more orders from merchants means more opportunities for delivery partners to earn,” Uber said in May 2024 when it announced its intention to acquire the Foodpanda business.

Meanwhile, Delivery Hero said Taiwan remains a key part of its long-term strategy. “The company remains focused on supporting Foodpanda’s position in Taiwan as it continues to deliver amazing experiences to its customers, riders, and vendors,” it said.

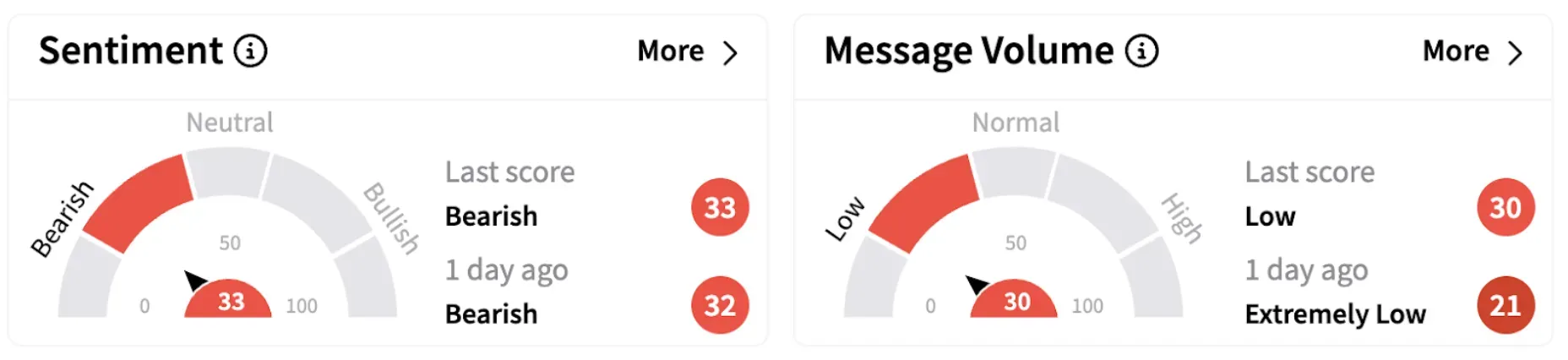

On Stocktwits, retail sentiment surrounding Uber continued to trend in the ‘bearish’ territory (33/100).

Uber shares have gained nearly 12% in 2025 but are down almost 10% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_justin_sun_resized_jpg_80141eb4e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)