Advertisement|Remove ads.

UBL Shares Rise On Premium Brand Growth, SEBI Analyst Sees Upside Ahead

- Despite a weaker Q2 due to heavy monsoons, the premium portfolio drove revenue growth.

- SEBI analyst highlights technical support at ₹1,750 for UBL stock.

- JPMorgan and Nuvama maintain bullish views with price targets between ₹2,050 and ₹2,400.

United Breweries (UBL) shares rose nearly 2% on Thursday after the company reported mid-single-digit net revenue growth in India despite lower beer volumes in the September quarter. Net revenue rose due to strong pricing, improved portfolio mix, and robust growth in premium brands like Kingfisher Ultra Max and Amstel Grande.

Heineken, its parent company, reported that India's quarterly performance was negatively impacted by an unusually strong monsoon season, which reduced beer consumption. However, this impact was partially mitigated by price increases in key states and a favorable product mix.

UBL: Brokerage views

Last month, brokerage firm JPMorgan maintained its positive stance on the stock but reduced its price target to ₹2,050 from ₹2,200, citing a challenging second quarter marked by significant weather-related disruptions.

Meanwhile, Nuvama highlighted its production expansion at its unit in Andhra Pradesh. They believe localisation can potentially improve margins and prevent stock-outs in the peak season, particularly Q1. Nuvama maintains a ‘Buy’ rating with a target price of ₹2,400.

UBL stock: Technical view

SEBI-registered analyst Financial Sarthis said that UBL stock has taken support at its previous breakout zone on the weekly scale. On the upside, they identified targets at ₹1,900 and ₹1,935, with support at ₹1,750 on a closing basis.

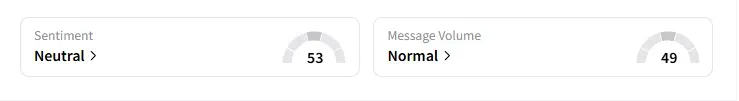

UBL: What is the retail mood on Stocktwits?

Data on Stocktwits showed that retail sentiment has been ‘neutral’ for a few weeks on this counter.

UBL shares have declined 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)