Advertisement|Remove ads.

UBS Sees Tesla Q2 Deliveries Miss Wall Street Estimates, But Sees Opportunity For Musk To Focus On Future Of EV Giant

Brokerage UBS now sees Tesla Inc.'s (TSLA) second quarter deliveries at 366,000, 10% below consensus, and expects demand to remain challenging.

UBS has a ‘Sell’ rating and $215 price target on Tesla shares. The price target represents a 37% downside to the stock’s closing price on Tuesday.

While the firm suspects the second quarter may not look great, the call is an opportunity for CEO Elon Musk to focus on his future vision, UBS says, as per TheFly.

Tesla shares edged lower by 2% during Wednesday’s morning trading session.

Last week, Barclays analyst Dan Levy said that he expects Tesla to report second-quarter deliveries of 375,000 units, which is 10% lower than the figure reported in the same quarter last year and below the consensus estimate.

However, the miss may be discounted in the shares given the company's "deemphasized fundamentals," Levy said in a research note.

The Tesla narrative has increasingly shifted to the robotaxi, with investors likely more focused on the June 22 robotaxi launch in Austin and the company's path to scaling autonomous vehicles, rather than the second-quarter (Q2) deliveries and overall fundamentals, the firm contended.

Likewise, Wells Fargo analyst Colin Langan also said earlier this month that the company’s Q2 deliveries look flat as compared to the first quarter.

In the first quarter, Tesla reported deliveries of 336,681 units, marking a dip of nearly 13% from the corresponding quarter of 2024 and the company’s worst quarterly performance in at least two years.

In 2024, the company reported deliveries of around 1.79 million units, down from 1.81 million deliveries in 2023.

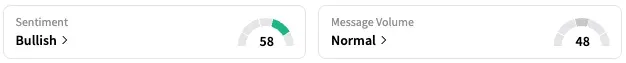

On Stocktwits, retail sentiment around TSLA remained within ‘bullish’ territory over the past 24 hours while message volume remained at ‘normal’ levels.

TSLA stock is down by 18% this year but up by about 78% over the past 12 months.

Read Next: Rubrik Acquires Predibase With Aim Of Slashing Costs By 80%, But Retail Remains Skeptical

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_xi_jinping_jpg_f2aa8420ba.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2219995127_jpg_47fff50a9f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244386520_1_jpg_e364bca397.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)