Advertisement|Remove ads.

UiPath Stock Rises Ahead Of Q4 Results Due Wednesday: Retail’s Convinced Of Long-term Potential

Enterprise automation and artificial intelligence (AI) software company UiPath, Inc’s. (PATH) fourth-quarter earnings report is scheduled to be released after the closing bell on Wednesday.

The Finchat-compiled consensus estimates call for adjusted earnings per share (EPS) of $0.19 and revenue of $425.45 million for the fourth quarter of the fiscal year 2025.

This compares to the year-ago quarter’s figures of $0.22 and $425.34 million, respectively.

UiPath’s guidance issued in early December calls for revenue of $422 million to $427 million. The company guided annualized renewal run-rate (ARR) in the range of $1.669 billion to $1.674 billion.

In the third quarter, UiPath’s ARR grew 17% to $1.607 million, the net new ARR was $56, and the dollar-based net retention rate was 113%.

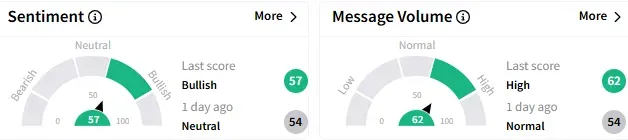

Retail sentiment toward UiPath stock on the Stocktwits platform turned to ‘bullish’ (56/100) from the ‘neutral’ mood that prevailed a day ago. The message volume perked to ‘high’ levels.

A bullish watcher said UiPath's earnings print is huge, adding that they would monitor whether the accumulated losses continue to shrink.

Another user said that if the guidance is good, it can be a great long-term hold, given UiPath’s discounted price and future market potential for automation.

UiPath stock climbed 2.90% to $12.08 in early trading. However, the stock is down about 7.6% year-to-date and it has traded in a 52-week range of $10.37-$25.47.

UiPath is a key holding of Cathie Wood-run Ark Investment’s flagship fund, the Ark Innovation ETF (ARKK). ARRK has 9.07 million UiPath shares valued at $106.48 million. The stock is the 20th biggest holding of the exchange-traded fund in terms of value.

The TipRanks-compiled average analysts’ price target for UiPath stock is $15.33, suggesting roughly 31% upside potential.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)