Advertisement|Remove ads.

United Airlines Delivers Upbeat Q3, Unveils First Post-Pandemic Share Buyback: Retail’s Exuberant

United Airlines (UAL) reported better-than-expected third-quarter results on Tuesday and also declared a share repurchase program for the first time since the pandemic.

The company said its board authorized a new share repurchase program for up to $1.5 billion of outstanding shares of common stock and warrants originally issued to the U.S. Treasury under the CARES Act and Payroll Support Program.

This is the airline’s first share repurchase program since the previous program in 2020 was suspended due to the COVID-19 pandemic.

Meanwhile, the firm announced a 2.5% rise in its revenue at $14.84 billion versus an estimate of $14.78 billion. Earnings per share came in at $3.33 compared to an estimated $3.17.

However, the airline witnessed a 15.1% decline in its net income of $965 million during the quarter.

CFO Michael Leskinen said the airline is now in a position to add a share repurchase program as it continues to invest in and deleverage its business. “We are simultaneously targeting net leverage below 2x in the next few years,” he said.

United said its capacity expanded 4.1% compared to the third quarter of 2023. Corporate revenues rose 13% YoY while premium revenues were up 5% YoY. Revenue from basic economy was up 20% YoY.

CEO Scott Kirby said that unproductive capacity left the market in mid-August as predicted, and the firm saw a clear inflection point in its revenue trends.

Following the news, shares of the airline were trading over 1% higher during Wednesday’s pre-market session as of 7:19 a.m. ET.

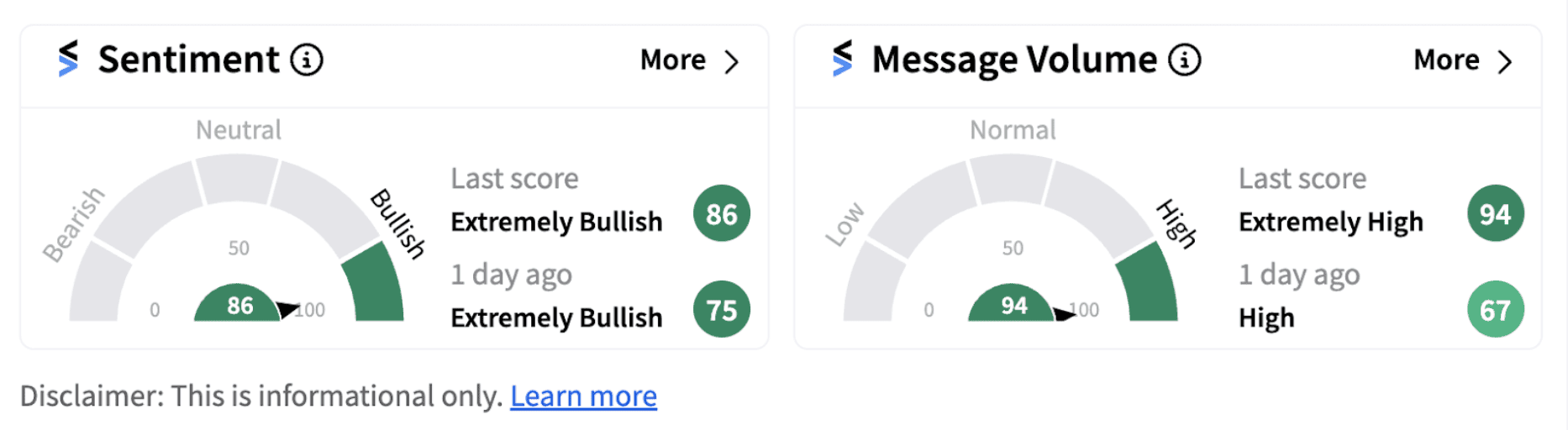

Retail sentiment on Stocktwits moved further into the ‘extremely bullish’ territory (86/100) on Wednesday morning, accompanied by ‘extremely high’ retail chatter.

Last week, the firm had announced its largest international expansion adding service to eight new cities.

The destinations include Nuuk in Greenland, Palermo in Italy, Bilbao in Spain as well as Madeira Island and Faro in Portugal. Three new non-stop routes are also being added from Washington D.C./Dulles, including year-round flights to Dakar, Senegal and new seasonal nonstop flights to Nice, France and Venice, Italy.

At the same time, United is also adding new direct flights from Tokyo-Narita to Ulaanbaatar, Mongolia and Kaohsiung, Taiwan and a new nonstop flight to Koror, Palau.

Meanwhile, one Stocktwits user believes shares of the firm may rally toward the $80 mark by the end of the year.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)