Advertisement|Remove ads.

UnitedHealth Stock Slides Pre-Market On Disappointing Full-Year Guidance, Q2 Earnings: But Retail Expects A Bounceback

UnitedHealth Group (UNH) on Tuesday reinstated full-year 2025 guidance after suspending it earlier this year, albeit the numbers have come in lower than Wall Street expectations.

The company now expects full-year revenue of $445.5 billion to $448.0 billion and adjusted earnings of at least $16 per share, below the $27.66 reported for full-year 2024.

Analysts on average were expecting the company to report full-year revenue of $449.07 billion and earnings per share of $20.9, according to data from Fiscal AI. The new outlook reflects higher realized and anticipated care trends, the company said.

The health insurer, however, said that the company expects to return to earnings growth in 2026.

Shares of UNH were trading 1% lower in the pre-market session at the time of writing.

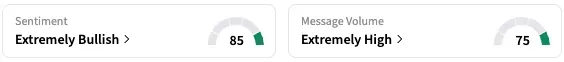

On Stocktwits, retail sentiment around UNH jumped from ‘bullish’ to ‘extremely bullish’ over the past 24 hours, while message volume rose from ‘high’ to ‘extremely high’ levels.

According to data from Stocktwits, retail chatter around UNH surged 742% over the past 24 hours and by about 70% over the past seven days.

A Stocktwits user remained bullish on the stock, casting aside any doubts following the earnings report.

Another opined that the stock will shoot up once the market opens.

For the second quarter, UNH reported revenue of $111.6 billion, compared to $98.9 billion in the corresponding quarter of last year, and above an expected $111.59 billion. Adjusted earnings came in at $4.08, below an expected $4.45.

Medical cost ratio jumped 430 basis points year-over-year to 89.4% in the quarter due to medical cost trends, which significantly exceeded pricing trends, and the ongoing effects of Medicare funding reductions. Medical cost ratio refers to the percentage of premiums used to pay for medical claims.

The full year 2025 medical cost ratio is now expected to be 89.25%, plus or minus 25 basis points.

UNH stock is down by 44% this year and by over 50% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_walmart_OG_jpg_8a74984dc4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347001_jpg_8286032c70.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lemonade_resized_jpg_fe42e63791.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)