Advertisement|Remove ads.

American Airlines Stock Gets A Redburn Upgrade: Analyst Sees 58% Upside With US Airline Industry Entering Goldilocks Period

Shares of American Airlines Group Inc (AAL) drew investor attention on Wednesday morning after Redburn Atlantic upgraded the stock to ‘Buy’ from ‘Neutral’ while raising the price target to $24 from $18.

The new price target represents a 58% upside potential from the closing price on Tuesday.

According to a CNBC report, Redburn analyst James Goodall believes the U.S. airline industry is entering a Goldilocks period.

Goodall noted that significant constraints on aircraft supply should force the industry to adopt capacity discipline in the medium to long term.

“Coupled with strong demand, particularly for international and premium, as well as growing high-margin revenue streams, we see a pathway for margin expansion and robust [free cash flow] generation for the US network airlines,” he said, according to the report.

Redburn’s outlook comes as American Airlines shares have declined nearly 12% over the past month following a disappointing first-quarter (Q1) earnings projection.

American Airlines had said it expects Q1 2025 adjusted loss per diluted share to be between $0.20 to $0.40 – wider than Wall Street’s estimated loss of $0.04. The company expects its full-year 2025 adjusted earnings per diluted share to be between $1.70 and $2.70.

Although the outlook appeared bleak, the company’s fourth-quarter (Q4) earnings report topped Street estimates. AAL reported a 4.6% year-over-year (YoY) revenue rise to $13.66 billion. Wall Street estimated revenue to come in at $13.42 billion.

The airline said the revenue performance was driven by its actions to adjust capacity, combined with continued demand strength. Total unit revenue rose 2.0% versus 2023.

Despite the prevailing investor pessimism, Goodall doesn’t believe the airline’s management has lost its focus on costs.

“American still operates with materially lower stage lengths versus peers, so it remains a somewhat under-appreciated fact that, on a stage-length-adjusted basis, its [cost per available seat mile excluding fuel and net special items] position is lower than its direct competition,” he reportedly said.

Moreover, the analyst believes American Airlines will witness its “greatest positive result” through 2025. He also expects the company’s earnings before interest and tax (EBIT) margins to expand this year and Atlantic unit revenues to continue outperforming its peers.

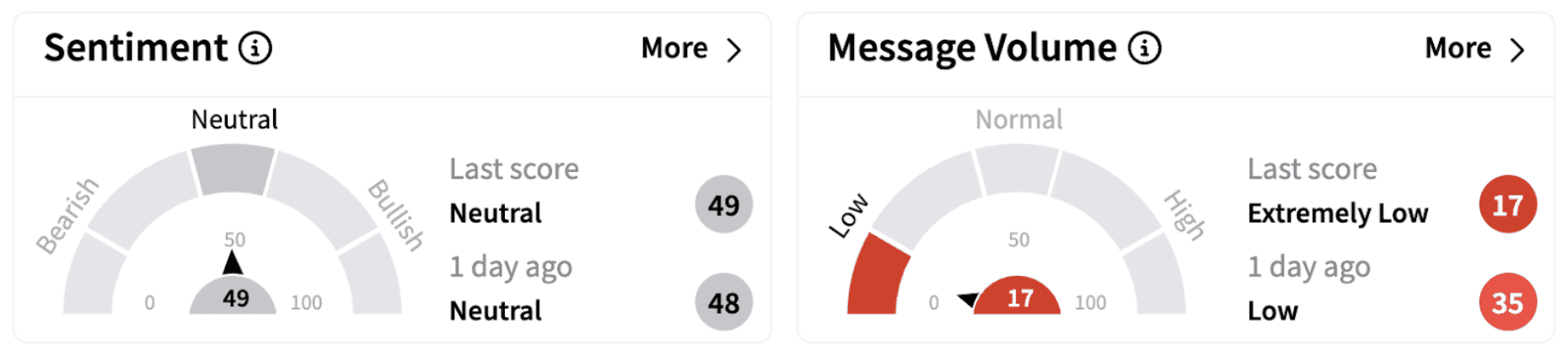

On Stocktwits, retail sentiment climbed marginally but continued to trend in the ‘neutral’ territory.

One Stocktwits user believes the share price could decline to $11 before hitting $18.

AAL stock has lost 11% in 2025 and is down nearly 1% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)