Advertisement|Remove ads.

UPS Stock Gets A Price Target Cut From Citigroup Amid Freight Market Softness

United Parcel Service (UPS) witnessed a price target cut from Citigroup to $112 from $114 ahead of the company’s third-quarter results later this month, with the firm citing a lukewarm quarter for the transportation sector.

Citigroup maintained a ‘Buy’ rating, according to TheFly. The firm expects "tepid" quarters for most transportation sector companies, citing soft freight rates and unfavorable supply and demand dynamics.

The ending of the de minimis exemption, a trade policy that allowed low-value imported goods to enter the United States without companies having to pay customs duties or taxes, has put pressure on parcel companies such as United Parcel Service and FedEx, and large retailers.

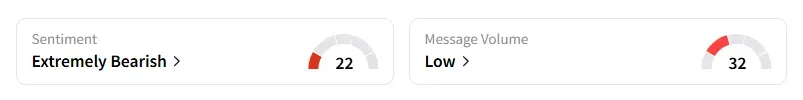

Retail sentiment on United Parcel Service dipped to ‘bearish’ from ‘extremely bearish’ territory a day ago, with message volumes at ‘low’ levels, according to data from Stocktwits. Shares of the company rose 0.5% in premarket trading on Monday.

The company is expected to post revenue of $20.93 billion in the third quarter and earnings per share of $1.33, according to data compiled by Fiscal AI. Last week, JPMorgan cut its price target on the stock to $85 from $96 and said that tariffs and trade policy uncertainty persisted while spot truckload rates remain subdued.

In September, Bank of America had noted increased pressure on volume and costs for the company following the end of the U.S. de minimis exemption. The firm said this would also result in a muted air peak season in 2025.

Shares of United Parcel Service have declined 34% this year and over 38% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: TMQ, CRML, USAR: Lithium, Rare Earth Stocks Rally Premarket As US-China Trade Dispute Heats Up

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)