Advertisement|Remove ads.

Upstart Holdings Stock Soars Aftermarket After Surprise Q4 Profit: Retail’s Exuberant

Upstart Holdings Inc (UPST) shares surged about 26% in the after-market trade on Tuesday after the company posted a surprise profit and its fourth-quarter revenue beat Wall Street’s estimates.

On an adjusted basis, the company posted earnings of $0.26 per share for the three months ended Dec. 31, compared with average analysts’ estimate of a loss of $0.15 per share.

According to Koyfin data, the company reported quarterly revenue of $218.96 million, compared with the average analysts’ estimate of $181.92 million.

Its net loss narrowed to $2.8 million, compared with $42.4 million in the same period last year.

Upstart’s total loans jumped to 245,663 from 129,664 in the year-ago quarter, while its transaction volumes rose 66% to $2.1 billion.

Its revenue from fees rose to $199.28 million from $152.86 million last year.

The company expects to post $1 billion in revenue in 2025, which, if it meets its projections, will be a record annual revenue for the AI lending platform.

Upstart also forecast a net interest income (NII) of about $80 million in 2025 and said it expects to at least break even this year. The company last posted a net profit in 2021.

“In Q4 of 2024, our business grew dramatically across all product categories, delivered Adjusted EBITDA at levels not seen since the first quarter of 2022, and came within a whisker of returning to GAAP profitability,” CEO Dave Girouard said.

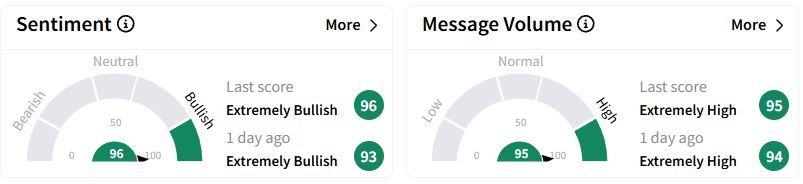

Retail sentiment on Stocktwits moved higher in the ‘extremely bullish’ (96/100) territory, while retail chatter was ‘extremely high.’

Users speculated if the stock could hit $350 soon, a level it last touched in 2021.

Over the past year, Upstart stock has nearly doubled.

Also See: Energy Transfer Stock Falls After-market On Q4 Revenue Miss: Retail Shrugs It Off

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)