Advertisement|Remove ads.

US Election 2024: VIX Crashes On Wednesday As Traders Find Solace In Certainty Post Trump Victory

With Donald Trump emerging victorious in the U.S. Presidential election traders appear to have found solace in the certainty following the conclusion of the event, apparent from the crash in the CBOE VIX. Last week, the volatility index shot up beyond the 23 levels.

VIX tends to rise ahead of crucial events like elections, referendums, the Federal Reserve's monetary policy announcement among other things.

Once the event is over and there is clarity regarding the same, volatility declines significantly which is reflected in the VIX prices. That’s what happened on Wednesday.

The CBOE VIX, which reflects investors' consensus view of future (30-day) expected stock market volatility, crashed nearly 20% on Wednesday as of 11:29 ET.

The iPath Series B S&P 500 VIX Short-Term Futures ETN ($VXX), which offers exposure to futures contracts of specified maturities on the VIX index, slid over 10% on Wednesday.

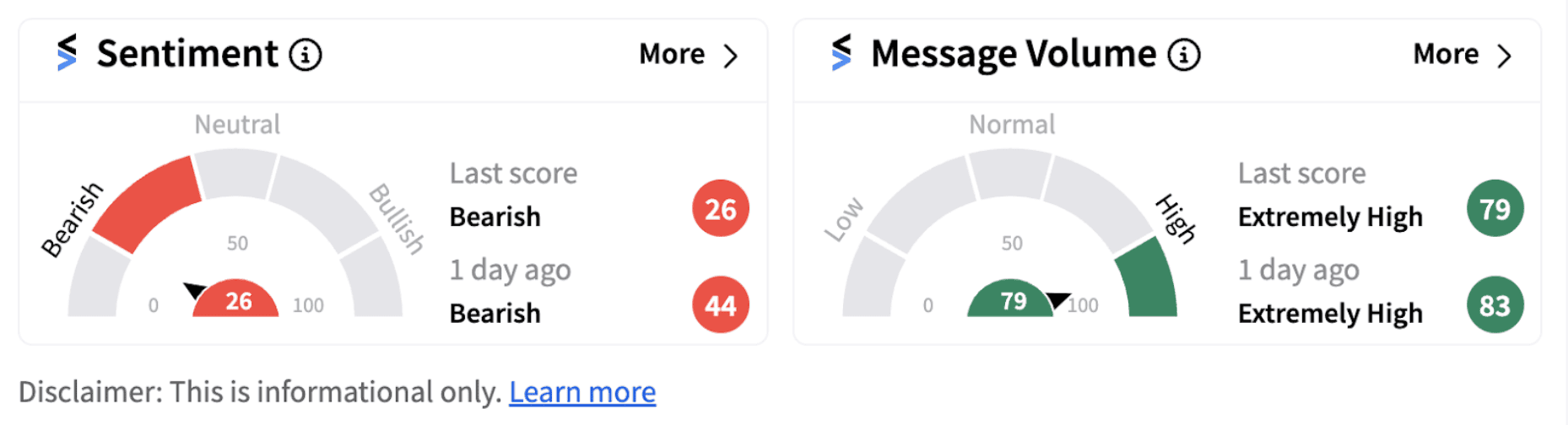

Retail sentiment on Stocktwits fell further into the ‘bearish’ territory (26/100), with message volume hitting ‘extremely high’ levels.

Some Stocktwits users noted the crash in volatility.

Notably, the VXX is down over 25% since the beginning of the year.

Meanwhile, equity markets have welcomed the Trump victory with the S&P 500 rising nearly 2% on Wednesday and the Nasdaq rallying over 2%.

However, bond markets sold off with yields shooting up to July highs as traders believe Trump’s economic policies may widen the fiscal deficit and stoke inflation.

Also See: US Election 2024: Here’s How Retail Reacted To Bonds Sell-Off Post Trump Victory

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221557373_jpg_2cb3ed82cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)