Advertisement|Remove ads.

US Oil Crashes Below $55 For First Time Since 2021 As Supply Floods The Market

- Supply keeps climbing, led by record U.S. output and rising OPEC+ production.

- Demand remains soft, especially in China, while geopolitical risk premiums fade.

- Lower oil is easing inflation, pushing U.S. gas prices below $3 a gallon.

U.S. oil prices fell below $55 a barrel on Tuesday for the first time since February 2021, extending a sharp slide as growing supply runs into softer global demand.

West Texas Intermediate crude dipped under $55 in early trading, a level last seen as the pandemic-era downturn was fading. Global benchmark Brent also slid, dropping below $60 a barrel and moving toward its lowest close in nearly five years.

Supply Keeps Rising As Demand Struggles

The move lower is the latest in a series that's accompanied ongoing market floods of oil. U.S. production hit a fresh record of 13.8 million barrels a day of oil and gas equivalent in September, newly released data from the Energy Information Administration show.

Meanwhile, OPEC and its allies, led by Russia, have been adding barrels on a monthly basis since April. The group agreed last month to increase output by a further 137,000 barrels a day in December.

Demand hasn't kept pace. Consumption growth has been sluggish, especially in China where broader economic weakness has sapped energy demand. The International Energy Agency has warned that the global oil market could be in surplus of more than 4 million barrels a day next year.

Market Signals Add Pressure

Hopes for a potential cease-fire between Russia and Ukraine have also reduced the geopolitical premium that had supported crude prices for much of the conflict.

Additional signs of strain are emerging within the oil market itself. Middle Eastern crude prices have moved into a bearish contango structure, while recent strength in gasoline and diesel pricing has faded, removing another source of support for crude.

Analyst Takes

Mohamed El-Erian, chief economic advisor at Allianz, said in a post on X that the latest move reflects how heavily supply dynamics are weighing on oil.

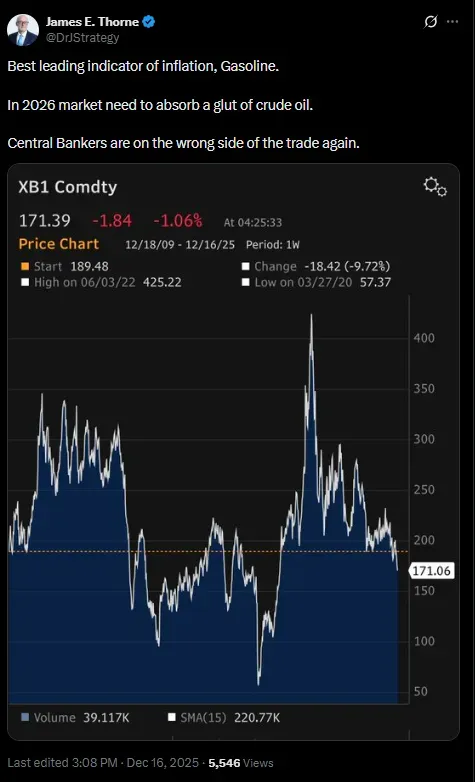

Meanwhile, James E. Thorne, chief market strategist at Wellington-Altus, said in a post on X that the drop in energy prices is already sending a clear signal. “Best leading indicator of inflation, gasoline,” Thorne said, adding that markets will need to absorb a glut of crude oil in 2026 and that “central bankers are on the wrong side of the trade again.”

Relief At The Pump

Lower crude prices are already filtering through to U.S. consumers. Gasoline prices have dropped below $3 a gallon nationwide, according to GasBuddy, with Christmas Day prices forecast at $2.79, the lowest since 2020, according to a report by Barron’s.

GasBuddy estimates the decline from last year’s levels could translate into roughly $521 million in savings for U.S. drivers over the holiday week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Emirates_jpg_2620b94b3d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)