Advertisement|Remove ads.

VA Tech Wabag Rallies On Strong Q4: SEBI RA Krishna Pathak Projects Rally Toward ₹1,789

Shares of VA Tech Wabag surged over 6% on Thursday, buoyed by a strong March quarter earnings report and renewed investor optimism.

The rally was further reinforced by a bullish technical setup, suggesting the potential for continued upside.

SEBI-registered analyst Krishna Pathak notes that the company’s Q4 performance exceeded expectations, with sharp improvements in revenue, profitability, and margins.

Revenue rose 23.8% to ₹1,156 crore, while net profit jumped 37.4% to ₹99.5 crore. EBITDA also grew 21.9% to ₹140.8 crore, highlighting strong operational leverage.

From a charting standpoint, Pathak highlights that VA Tech Wabag has broken above a long-term descending trendline, signaling a potential trend reversal and renewed bullish momentum.

The price has found consistent support around the ₹1,345 level, which aligns with its 9-day exponential moving average (EMA).

Thursday’s price action also formed a bullish candle with a higher high–higher low pattern, reinforcing the technical strength.

Pathak sees an attractive accumulation opportunity in the ₹1,435–₹1,441 zone and adds that the stock is currently testing the ₹1,550–₹1,600 resistance band.

A decisive breakout above this level could pave the way for an aggressive upward move.

He adds that if the stock sustains above ₹1,600, short-term targets are projected around ₹1,698–₹1,789.

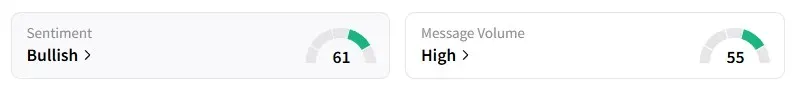

Retail sentiment on Stocktwits has also turned ‘bullish’, lending further momentum to the ongoing rally.

VA Tech Wabag shares have fallen 9% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)