Advertisement|Remove ads.

Attractive Entry Point? Varun Beverages Trades Below Historical Valuations, Says Investment Advisor

Varun Beverages (VBL) has been in a downtrend, losing nearly 20% in the last six months.

One of the largest beverage companies in India and the official bottler of PepsiCo products in multiple territories, the stock is trading below its historical price-to-earnings (P/E) average, presenting a potential buying opportunity, according to SEBI-registered investment advisor Wealth Wishers.

They highlighted that VBL is a fundamentally strong company with excellent management, brand loyalty, and international growth potential.

While short-term challenges include competition from Reliance and seasonal sales fluctuations, long-term growth can be driven by international expansion, diversification of product offerings, and strategic backward integration.

Fundamental View

Wealth Wishers noted that it saw a weak summer quarter due to milder weather conditions. Additionally, Reliance acquired Campa Cola, leading to aggressive pricing in the carbonated drinks and water segments. This could impact VBL’s market share, particularly in price-sensitive areas.

One of the biggest concerns for VBL remains the risk of dependency on its sole major client, Pepsi. However, Pepsi’s brand loyalty minimises the risk of immediate market share loss. Also, the analysts highlighted that 20% VBL’s revenue comes from overseas operations, reducing Reliance's competition risk.

VBL is expanding into ice cream, energy drinks, and snack manufacturing with PepsiCo collaboration.

Investment Call

According to Wealth Wishers, VBL stock currently trades below its historical PE average, indicating it may be attractive for long-term investors. But they advised traders to monitor market response to competitive pressure and international expansion.

What Is The Retail Mood?

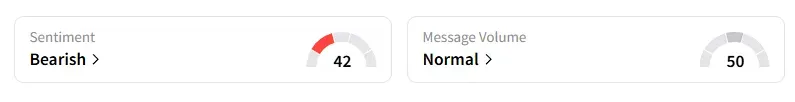

Data on Stocktwits showed that retail sentiment has been ‘bearish’ for a week.

VBL shares have declined 30% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)