Advertisement|Remove ads.

Vedanta Shares Crash After Viceroy Report Sparks Governance Fears: SEBI RA Urges Caution Near ₹400 Support

Vedanta shares crashed nearly 8% on Wednesday afternoon, following a bearish report on its parent group, Vedanta Resources Limited (VRL), which reignited concerns about corporate governance, particularly regarding promoter pledges and debt servicing.

Viceroy Research, a firm known for forensic financial investigations, alleges that VRL is a “financial zombie” kept alive by systematically siphoning funds from Vedanta: a strategy that now threatens both companies with collapse. They are short on the debt stack of Vedanta Resources, the heavily indebted parent and majority owner of Vedanta.

The report alleges that VRL lacks meaningful operations of its own and continues to exist by siphoning unsustainable dividends, brand fees, and intra-group loans from Vedanta. It draws a parallel to a parasitic relationship, where the host (Vedanta) is being drained of its resources.

Viceroy's note asserted that "the entire group structure is financially unsustainable, operationally compromised, and presents a severe, under-appreciated risk to creditors."

SEBI-registered analyst Vijay Kumar Gupta highlighted that, structurally, the stock is in a fragile position on its technical charts; however, long-term investors may find an opportunity near key support zones. He remains cautious in the short term while watching for price stability.

In June, Vedanta had announced an interim dividend of ₹7 per share, reflecting a yield of over 7%. It also sold a 1.6% stake in its subsidiary Hindustan Zinc, raising ₹3,028 crore, according to a stock exchange filing.

Gupta notes that the recent stake sale in Hindustan Zinc is part of a broader deleveraging effort aimed at improving promoter liquidity and reducing refinancing pressure.

Vedanta is also undergoing a long-awaited demerger into distinct verticals (aluminium, oil & gas, zinc, power, etc.). Gupta added that while the process has been delayed, investors are waiting for concrete updates before pricing in its benefits.

Additionally, the global copper tariffs and commodity volatility has weighed on the stock in recent times. Vedanta broke sharply below ₹450 with high volume, confirming a bearish breakdown from the ₹460–₹470 resistance band.

Gupta pegged ₹420–₹400 as the immediate demand zone (an area that has held up in previous corrections and sparked reversals). If price stabilizes here with reversal candles, short-term bounce opportunities may emerge, according to him.

If ₹400 breaks, then ₹385 is the next level to watch. A close below ₹385 could trigger further downside toward ₹360. On the upside, the stock needs to reclaim ₹470 with conviction and volume to re-enter a bullish structure. Until then, short-term rallies may face selling pressure.

Gupta advised traders not to enter new positions but to wait for confirmation: either a bounce from the ₹400 demand zone or a reclaim of the ₹470 resistance. Fundamentals remain solid with improving balance sheet and dividend support, but the technical structure demands patience, he concluded.

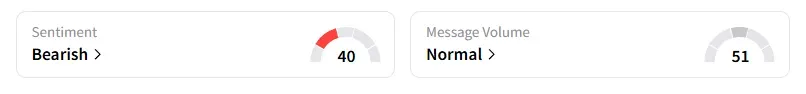

Retail sentiment on Stocktwits has turned ‘bearish’ on this counter.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)