Advertisement|Remove ads.

Vedanta Shares Slide As Indian Government Flags Four Key Demerger Concerns

Vedanta’s shares dropped nearly 4% to ₹444.15 on reports that the Indian government raised multiple concerns over its demerger during the National Company Law Tribunal (NCLT) hearing today.

The government highlighted that the proposed demerger could weaken Malco Energy’s finances. They also flagged asset misrepresentations and hidden liabilities among other concerns.

Vedanta defended its position, stating that all creditors and stakeholders support the demerger. The company assured it is ready to provide corporate guarantees to safeguard government dues and argued that there is no legal requirement for further disclosures.

The matter is scheduled for final hearing on October 8.

NCLT Hearing: Government vs Vedanta

The government highlighted four major concerns at the NCLT hearing, according to a report by CNBC-TV18. These include potential financial risks post-demerger, misrepresentation of hydrocarbon assets, inadequate disclosure of liabilities, and violations of SEBI’s disclosure norms.

According to the government, these issues could jeopardize the recovery of dues and weaken the financial stability of the demerged entity, Malco Energy.

Officials reportedly claim that while Vedanta currently holds assets worth over ₹2 lakh crore, 12.3 times the government’s total demand of ₹16,000 crore, the asset base is expected to shrink significantly after the demerger.

Malco Energy, the new entity, is said to have ₹29,000 crore in assets and a negative net worth as of March 2024, making it vulnerable to liquidation. The government further accused Vedanta of misrepresenting sanctioned exploration blocks as assets and taking large loans against them without proper approval. Undisclosed arbitral claims of more than ₹5,900 crore have also been flagged.

What Is The Retail Mood?

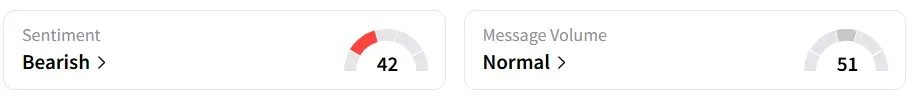

At the time of writing, Vedanta was the top trending stock on Stocktwits. Retail sentiment remained ‘bearish’. It was ‘bullish’ a week earlier.

Year-to-date, the stock has gained around 3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)