Advertisement|Remove ads.

This Sportswear Stock Tumbled 8% Today After Wall Street Slashed Price Targets: Is It Part Of Your Portfolio?

VF Corp. (VFC) shares tumbled nearly 8% during midday trading on Thursday after two brokerages lowered their price target, with TD Cowen noting that the sportswear maker’s working capital metrics and unsustainably low capex create an uncertain path for free cash flow improvement.

TD Cowen cut the price target on VF Corp to $13 from $15, according to TheFly. BNP Paribas Exane analyst Laurent Vasilescu downgraded the stock to ‘Underperform’ from ‘Neutral’ with a price target of $10, down from $11.

The retail user message count on VF Corp jumped 727% in the last 24 hours on Stocktwits as of Thursday morning, after its first-quarter results were announced on Wednesday.

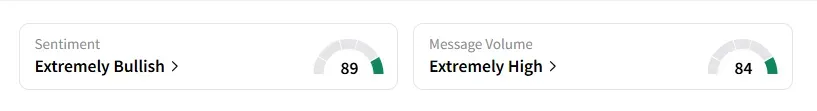

Retail sentiment on the stock remained in the ‘extremely bullish’ territory, with chatter at ‘extremely high’ levels, according to Stocktwits data.

A user on Stocktwits noted that the stock could dip more, but said if one believes the turnaround is real, then it could be a long-haul buy.

On Wednesday, VF Corp’s CFO Paul Vogel said the company expects the incremental annualized tariff impact to be between $100 million and $120 million, down from its prior estimate of $150 million as it navigates U.S. President Donald Trump’s levies on global trading partners.

VF Corp’s first-quarter revenue and profit beat estimates, with CEO Bracken Darrell noting that new products were on the way, and recent supply chain improvements are helping the firm bring them to market faster.

Shares of VF Corp had closed up 2.5% on Wednesday. The stock has lost over 45% of its value so far this year and has declined 29% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Norwegian Cruise Stock Shot Up 10% Today – Find Out Why

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)