Advertisement|Remove ads.

Victoria's Secret Stock Slips As Trump Tariff Jitters Outweigh Q4 Earnings Beat: Retail Cheers New CEO's Turnaround Efforts

Shares of Victoria's Secret (VSCO) slipped more than 5% in after-hours trading on Wednesday, even as the lingerie and cosmetics retailer topped Wall Street expectations on fourth-quarter earnings. Retail investors, meanwhile, cheered the opportunity to buy into the dip.

Victoria's Secret's earnings per share surpassed estimates, coming in at $2.60, while revenue topped estimates, coming in at $2.11 billion.

Comparable sales for Q4 went up 5% year over year. The latest earnings were on watch for turnaround efforts under CEO Hillary Super, who took over the reins in September.

"I am pleased with the strength of our fourth quarter holiday results, which saw sales up in both our Victoria's Secret and PINK brands and our powerhouse Beauty business," said Super.

"The teams focused on execution and drove healthy margins, controlled costs, and managed inventory levels extremely well in a highly competitive and promotional holiday environment."

The company said it saw sales growth across most major merchandise categories in stores and digital channels and across its North American and international businesses.

For its guidance, the company cited an "uncertain" macro environment, shift in consumer confidence, and headwinds from unseasonal weather in the U.S.

U.S. President Donald Trump’s tariffs have resulted in several retailers warning of higher prices in coming months. Trump recently announced an additional 10% levy on imported Chinese goods after instituting a 10% tariff earlier.

Victoria’s Secret reportedly could see operating income impact between $10 million to $20 million as a result of increased tariffs on China.

The company expects Q1 net sales between $1.30 billion and $1.33 billion, below the consensus estimate of $1.4 billion.

It projected fiscal year 2025 net sales in the range of $6.2 billion to $6.3 billion versus net sales of $6.204 billion in fiscal year 2024. That compares to the consensus estimate of $6.21 billion.

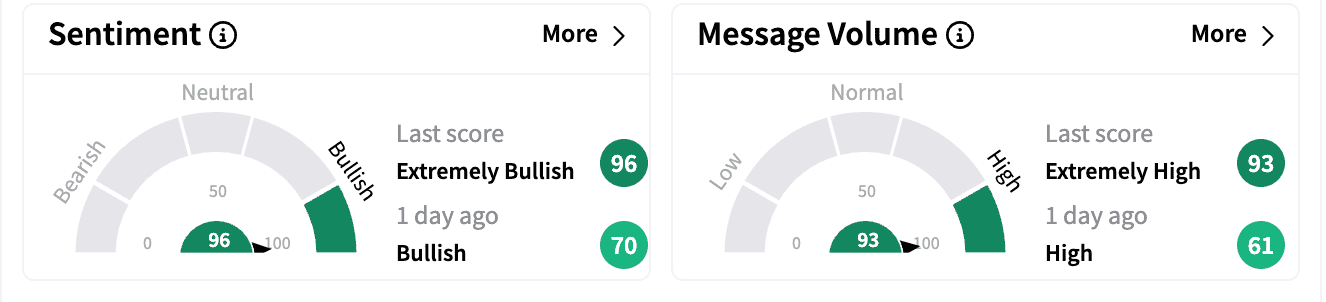

Sentiment on Stocktwits improved to 'extremely bullish' from 'bullish' a day ago. Message volume climbed to 'extremely high' from 'high.'

One bullish investor on Stocktwits suggested the company's market cap was low despite tariff impact.

Another said the company was "undervalued."

"After my first holiday season with the business, I continue to be optimistic about our future, our opportunity to further differentiate the brands with compelling storytelling and make even deeper emotional connections with our customers," Super said.

Victoria's Secret stock is down 46% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)