Advertisement|Remove ads.

Vigil Neuroscience Stock Triples Pre-market On Acquisition By Sanofi: Retail Goes Super Bullish

French pharmaceutical major Sanofi SA (SNY) said on Thursday that it would acquire U.S.-based Vigil Neuroscience, Inc. (VIGL) for about $470 million.

Vigil is a clinical-stage biotechnology company focused on developing novel therapies for neurodegenerative diseases. The company said the acquisition will allow Sanofi to expand its neurology pipeline.

The acquisition also includes Vigil’s investigational medicine VG-3927, which is being evaluated in the treatment of Alzheimer’s disease.

However, Sanofi will not acquire Vigil’s second molecule program, VGL101, being studied in patients with a rare neurodegenerative disease called Leukoencephalopathy.

Under the deal, Sanofi will acquire all outstanding common shares of Vigil for $8 per share in cash at closing. This represents a 246% premium to Vigil’s closing price of $2.31 on Wednesday.

Vigil’s shareholders will also receive a non-transferable contingent value right (CVR) per Vigil share, which will entitle its holder to a deferred cash payment of $2 upon the first commercial sale of VG-3927.

The companies expect the transaction to close in the third quarter (Q3) of 2025, subject to customary closing conditions. The deal is not expected to have an impact on Sanofi’s financial guidance for 2025.

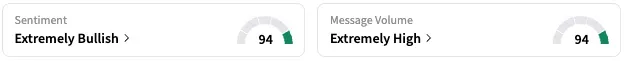

On Stocktwits, retail sentiment around Vigil jumped from ‘bearish’ to ‘extremely bullish’ over the past 24 hours while message volume jumped from ‘low’ to ‘extremely high’ levels.

VIGL stock was up about 242% in pre-market trading on Thursday. The stock has gained 31% this year but has fallen over 37% over the past 12 months.

Nasdaq-listed shares of Sanofi, meanwhile, are up by about 10% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)