Advertisement|Remove ads.

Vodafone Idea Shares Slide After Indian Government Reportedly Rules Out Fresh Bailout

Shares of Vodafone Idea slumped by over 10.5% on Tuesday, following reports that the Indian government may not bail out the cash-strapped telecom operator.

According to a CNBC-TV18 report, Minister of State for Communications Chandra S. Pemmasani has stated that the Centre is not considering an additional relief package for Vodafone Idea.

“Whatever we wanted to do has already been done,” Pemmasani said, referring to the 2021 package under which nearly ₹53,000 crore of the telco’s dues were converted into equity. Following this move, the government currently holds a 49% stake in the company.

He also ruled out any further equity conversion, noting that such a move would effectively make Vodafone Idea a public sector undertaking, something the government is not considering.

AGR Dues Risks

Vodafone Idea continues to grapple with heavy liabilities. Its adjusted gross revenue (AGR) dues stand at over ₹83,000 crore, while overall obligations to the government exceed ₹2 lakh crore. With the moratorium on payments set to end in March 2026, the company will need to resume annual payments of approximately ₹18,000 crore.

Despite narrowing its Q1 loss to ₹6,608 crore and reporting a 15% year-on-year increase in average revenue per user (ARPU), the beleaguered company has warned that without additional funding, insolvency remains a risk.

Management has also indicated that it is exploring non-banking channels to raise capital for network expansion and operational requirements.

The company’s woes have worsened following a Supreme Court decision rejecting its plea to waive ₹45,000 crore in interest and penalties on AGR dues. With the four-year moratorium on AGR payouts set to end in September, Vodafone Idea faces a tight financial squeeze.

Private Funding Hopes

Earlier this month, Vodafone Idea reportedly initiated early-stage talks with private credit funds, including Davidson Kempner, Oaktree, and Värde Partners, to raise a small tranche of debt.

The company could run out of funds to sustain its capital expenditure program by the fourth quarter of the current financial year if it is unable to raise capital.

Stock Watch

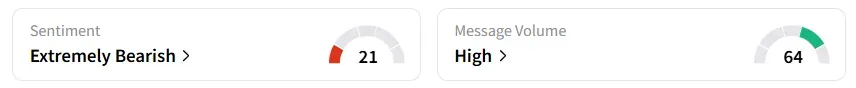

Vodafone Idea ranked among the top 5 trending stocks on Stocktwits, with retail sentiment sliding from ‘bearish’ to ‘extremely bearish’ over the past week, amid ‘high’ chatter on the platform.

Vodafone Idea shares are currently trading 9.2% lower at ₹6.72.

While the stock has gained in five of the past six sessions, its year-to-date losses exceed 16%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233231242_jpg_8d76eb3b7a.webp)