Advertisement|Remove ads.

VivoPower Just Announced A Deal That Could Return It To Group-Level Profitability

- VivoPower said the deal implies an enterprise value of about $40 million.

- The 40MW-plus facility is powered entirely by renewable hydroelectric energy.

- The acquisition is expected to close in January 2026.

VivoPower International PLC (VVPR) stock rose 3% on Tuesday after the company signed an agreement to acquire a data center facility in Norway, a move expected to add about $10 million in earnings before interest, tax, depreciation, and amortization (EBITDA).

The acquisition will be funded through deferred vendor finance and a tranche of convertible preference shares, with closing expected in January 2026.

VivoPower Deal Contours

The company said the deal implies an enterprise value of about $40 million, roughly four times pro forma EBITDA, and is expected to be highly accretive, bringing VivoPower back to group-level profitability upon closing. The company has reported net losses over the past three fiscal years.

The 40MW-plus facility is powered entirely by renewable hydroelectric energy, with access to low-cost electricity priced below $0.035 per kilowatt-hour. It currently offers more than 40MW of energized capacity, with an additional 40MW targeted for potential approval in 2026.

VivoPower plans to use the site as the foundation of its Power-to-X strategy under its Caret Digital platform, with the longer-term goal of repurposing the asset from blockchain compute hosting into a Sovereign AI Hub supporting carbon-neutral AI workloads.

The company recently announced the submission of Form F-4 to the SEC for the planned business combination between its subsidiary, Tembo e-LV, and Cactus Acquisition Corp, a special purpose acquisition company. The transaction is anticipated to close in March 2026.

How Did Stocktwits Users React?

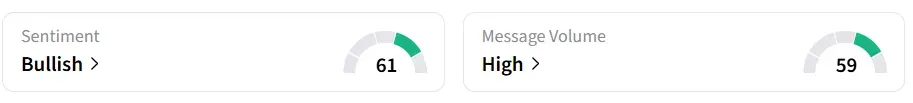

Retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ a day earlier, amid ‘high’ message volumes.

Year-to-date, the stock has surged more than 97%.

Read also: Why Did RYVYL Stock Slump 11% In Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)