Advertisement|Remove ads.

Waaree Energies Climbs To 6-Month High After US Solar Order; SEBI RAs See Fresh Breakout Ahead

Waaree Energies surged to a 6-month high of ₹3,140 on heavy volumes last week after its U.S. arm, Waaree Solar Americas, received a 540 MW solar module supply order.

The company said that the project involves 270 MW delivery in 2025 and another 270 MW between 2027–2028. The client is a prominent U.S.-based developer and operator of utility-scale solar and energy storage projects.

SEBI-registered research analyst Rohit Mehta observed that the stock hit ₹3,111 after the announcement, closing over 5% higher in the final session of June with volume exceeding 6.7 million shares — more than twice the 30-day average.

He sees key resistance at ₹3,141 and said a sustained breakout could open room toward the all-time high of ₹3,743.

Strong support zones are placed between ₹2,491–₹2,535 and ₹2,026–₹2,086, according to Mehta, who called the stock’s current momentum “bullish” as long as it sustains above ₹2,900.

SEBI-registered analyst Rajneesh Sharma echoes a similar view. He said the stock is attempting a reversal from recent lows and is displaying a visible cup and handle pattern on the daily chart, with repeated rejections near ₹3,100.

He pegged the ₹2,500–₹2,670 zone as strong support and noted that a breakout above ₹3,100 with volume could trigger a sharp rally.

A short-term bias remains bullish if it holds above ₹2,900, Sharma said, adding that key indicators such as volume spikes and RSI strength support the setup.

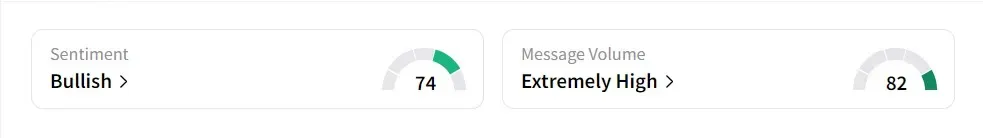

On Stocktwits, retail sentiment for Waaree Energies was ‘extremely bullish’ amid ‘extremely high’ message volume.

The stock has risen 8.4% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)